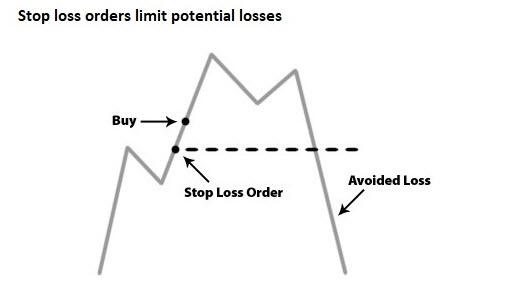

How to set your stop losses in trading

A good exit from a trade is no less important than a good market entry. The exit may be a result of a take profit or a stop loss order. The latter, of course, is a sadder thing than the former. However, the reality is so that foregoing the protection of a stop loss and letting your losses run is even worse.

To stop loss or not to stop loss is the classic subject of opinion wars among traders. The things listed below are nothing more than a humble opinion accompanied by some arguments. The decision is always yours to make!

The main benefits of stop loss orders are:

- The elimination of uncertainty. With a stop loss, you always know the worst-case scenario. This complies with risk management pretty well as it allows you to keep track of your money all the time.

- The psychological comfort. Once a stop loss decision is made, you have accepted the risk. Your brain will be free of doubts and able to function efficiently.

- The protection from black swans that can wipe off your account (remember what happened to Swiss franc in January 2015?).

If you think that using stop losses is the option you'd like to take, you'll need to make a couple of decisions. The first choice will be whether to set the size of a stop loss for a particular trade (discretionary stop) or use a stop loss defined by the rules of your trading system (system stop).

This choice naturally depends on whether you use a trading system or not. If you do, then there's likely a standard stop size or a method you are to oblige.

If you don't have particular guidance for a stop loss, there are 5 variants:

- Equity stop is derived from the size of your account (typically 1-5%). For example, if your equity is $1000, 1%-stop will equal to $10. If you trade EUR/USD, that will be 100 pips for a 0.01 volume (1 mini lot) or 10 pips for 0.1 volume (1 micro lot). Such an approach is well correlated with money management, although it doesn't take into account what you actually see on the chart.

- Chart stop, on the contrary, is based on your technical analysis. For buy trades, stop losses are placed below support levels, while for sell positions they are put above resistance levels.

- Volatility stop is adjusted to - no surprise! - market volatility. When it's high, you need a bigger stop loss so that it's not hit accidentally. When the overall volatility is low, a stop loss can be smaller as well. You can use Bollinger Bands to measure volatility.

- Time stop is a simple concept: your position is closed after a certain time has passed. This can be achieved with the help of Expert Advisors (EA). This option is kind of distant from the actual market events and looks contingent.

- Margin stop is listed in textbooks, but we would rather avoid recommending it. The idea is that you divide your capital into several equal parts and put only one at the account. Then the potential margin call acts as a stop loss. That seems like a piece of convoluted logic and doesn't allow making multiple trades at a time.

To sum up, the best strategy seems to use equity stops and adjust them to the charts, while making allowance for volatility. This way you'll be having the advantages of the first two approaches.

Don't forget that a stop loss shouldn't necessarily be static. The so-called 'trailing stop' will follow the price - but only if the price moves in your favor. If you opened a buy trade, a trailing stop will always move up. If you decided to sell, your trailing stop will only go down.

A trailing stop is aimed not only to limit potential loss but also lock in a trader's profit. In other words, with trailing stop your possible loss is known in advance and can't be exceeded, while your profit has no particular ceiling. The key parameter of a trailing stop is the distance between its exit point and the current price.

Choose it wisely: remember that intraday price action can be very choppy, so an extremely tight stop (let's say, of 5 pips) will be pointless. Trailing stops are mostly recommended for trend-following trades that last for some time.

The last but not the list: once a stop loss is set, don't widen it relative to the entry point. When you set a stop loss, you made an analysis of the situation and this analysis led you to this decision. When you start cutting the trade some slack and increase the stop hoping that the unfriendly market will finally reverse in your favor, you make 3 mistakes:

- You suffer from the stress of trying to patch up a losing trade and damage your nerves.

- You devalue your initial judgment and destroy your trading skills.

- You lose your time by constantly watching the trade that could have been left on its own if you stuck to the initial stop loss or a proper trailing stop.

Conclusion

It's certainly up to you whether to use stop loss orders or not but experience shows that if you make them your habit and fully integrate stops in your trading, you will be able to save yourself and your deposit from a lot of pain and develop as a trader much faster.

This article was submitted by FBS.