In the FX world, nothing captures differentials in Chinese and US growth like AUD/CAD. Australia and Canada are tied at the neck to their trading partners.

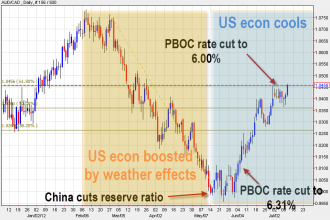

Early in the year, AUD/CAD declined as the US economy showed signs of surprising to the upside. Jobs were plentiful and economists were talking about 3% growth. At the same time, worries about slower Chinese growth were beginning to seep in. AUD/CAD fell below parity from 1.0750.

By May, it was clear that US growth surprises were sparked by unusually warm weather. Since then, it has been payback time. In China, officials began to acknowledge a slowing economy by lowering the banking reserve ratio and then cutting rates.

What’s Next

AUD/CAD rallied to the highest since late March today and is flirting with the 61.8% retracement of the March-May fall. A clear break higher would point to a return to 1.0750.

Chinese growth is slowing but policymakers there still have the ability to introduce stimulus spending or cut rates. In the US, politicians are unlikely to act before the Nov election and if the Fed rolls out QE3, the effect on growth will be low. There is always the risk of a sharp Chinese slowdown but US growth is also vulnerable.

Unfortunately, the trade isn’t that simple. There is a third player — Europe. Money is fleeing the eurozone in all directions but its favorite recent home is Australia where interest rates are highs. EUR/AUD is down 10-cents since late-May and the trade is looking frothy.

AUD is especially vulnerable to a big blowup in risk appetite, but if that doesn’t happen, AUD/CAD should continue higher. Even if risk assets begin to blow out, the low volatility in AUD/CAD will keep losses minimal.