Bill Gross is on twitter talking about the Italian yield curve inverting.

An inverted curve means short term bonds are paying more than long term bonds. Italian 2s are at 7.05% compared to 10s at 6.87%.

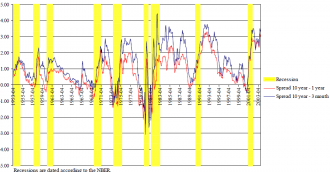

I’m not sure about internationally but an inverted yield curve has predicted every US recession since the 1950s and has only once sent a false signal (a recession narrowly avoided in 1967). It also occurred in Nov 1929.

The strange thing is that academics still haven’t figured out exactly why the curve tends to invert but the consensus is that it signifies liquidation and/or a credit crunch, which certainly coincides with the reports from Italy.

What happens is that the crunch we are seeing now leads to real losses in the financial sector and the productive sector that will show up in 6-9 months.

As the ancient Romans would say, 2012 will be an annus horribilis in Italy.