Some big moves in the rates market today

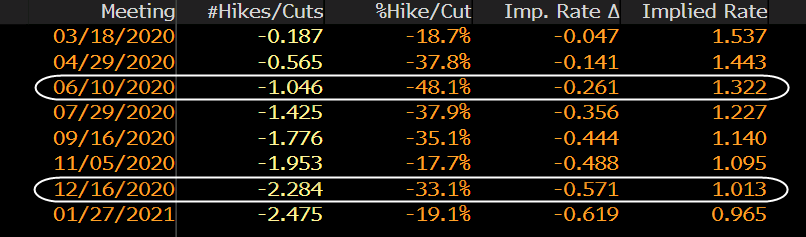

Fed funds futures are pricing in two full rate cuts by the end of the year, with the first one priced in for the June meeting as of today.

There has been some extravagant movement in the rates market today, with US 10-year yields down by nearly 10 bps at the lows and is still under 1.40% currently.

The reaction here is largely to do with fears surrounding the coronavirus outbreak and its impact towards the global economy but really, two Fed rate cuts? I'm not too sure.

This could be one of the areas for traders to look at in judging whether or not the recent movement in the market is "overdone" but at the same time, it is still premature to judge the overall impact of the virus outbreak on the global economy.

In any case, this is also a spot to watch for gold traders. If fears surrounding the virus outbreak start to ebb and the impact towards the US and global economy is minimal, there is quite a bit of pain to be had after the recent surge higher over the past few sessions.