The US non-farm payrolls tomorrow is the key risk event this week

And we're sitting in what seems to be a bit of a lull in the run up to the release on Friday.

Equities are slipping a little today while the dollar is holding steady but they aren't anything that really stands out in the context of trading over the past two weeks.

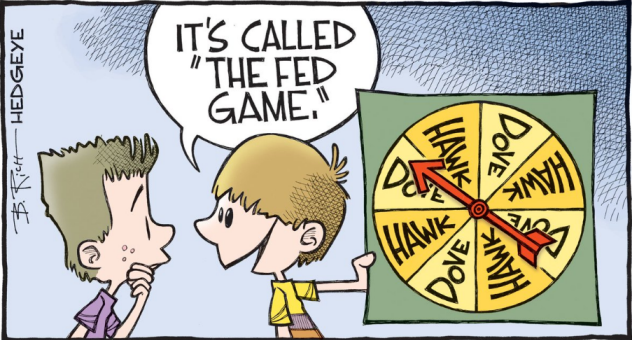

The market seems to be hoping that tomorrow's NFP release will provide some answers on how to proceed next but barring any short-term or kneejerk reaction, we may not get much else to help resolve the inflation and Fed debate for the time being.

Let's try and explore the significance of the jobs report tomorrow.

For one, the Fed isn't going to concede its current stance no matter the number tomorrow. Powell remains adamant now isn't the time to talk about or consider tapering and one data point isn't going to change that.

The April non-farm payrolls missed big time but there were two market reactions to that. The first being to the headline and then the fade thereafter, as there was a slight realisation that underlying conditions aren't as bad as what the figure suggested.

It could be the case that market participants may view tomorrow's report in similar light and if that is the case, it wouldn't really help resolve anything.

A poor headline figure is to ultimately be attributed to the lack of pull factor from businesses in hiring workers, rather than there being a lack of demand instead.

A strong reading on the other hand, will just help to bolster the inflation debate but unless Powell & co. are going to provide some clarity before the weekend, we may go into the FOMC blackout period (next two weeks) with more anxiety until 16 June.

As much as there is some anticipation of a potential Jackson Hole pivot, the Fed may yet wait until labour market conditions settle itself in late Q3 when most jobless benefits are due to expire - making tomorrow's release yet another pointless one.