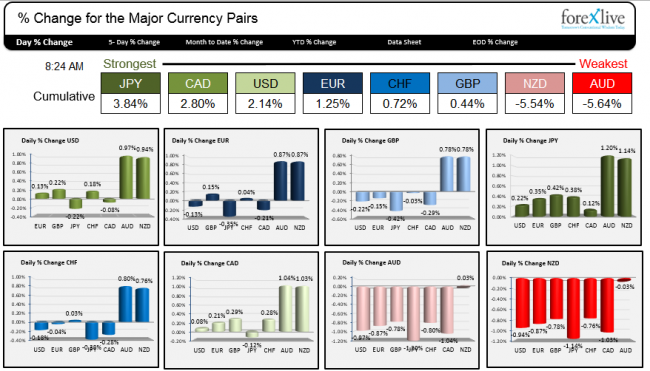

The main movers in the forex market against the USD is the AUDUSD and the NZDUSD. The rest of the pairs are very contained with the EURUSD range at a mere 29 pips and the GBPUSD at 60 pips.

The Strongest: JPY.

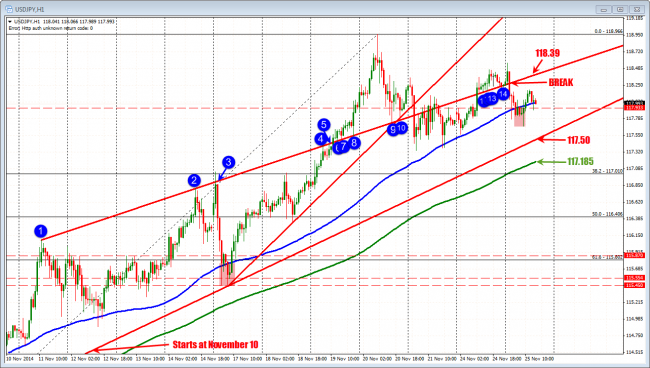

The main story behind the rise is the currency has gone too far. Most of the change is against the AUD and the NZD. The USDJPY is down on the day with the selling starting when the price fell below a trend line that has slashed through the chart and provided resistance and support (see: “Forex Technical Trading: USDJPY reasserts the bullish momentum” from yesterday“).

The pair has moved below and back above the 100 hour MA (blue line in the chart below). Yesterday and on Friday, the pair found support buyers against the MA line. The move back above the slashing trend line should have pushed the pair higher in trading. The corrections from major peaks since October 29th have not taken more that 3 days to make a new high going back to October 29th. It has been over 3 days since the high from November 20th. So there is some slowing of the trend.

Still….there needs to be a move below the 100 hour MA (and stay below) .

The Weakest: NZD and AUD

The AUDJPY fell below trend line and MA lines on the hourly chart. The 101.00 level and the 200 hour MA (green line at 101.63) are risk levels now. The pair has been consolidating as the AUD stays weak. The consolidation of the

AUDJPY fell below trend lines and 100 hour MA.