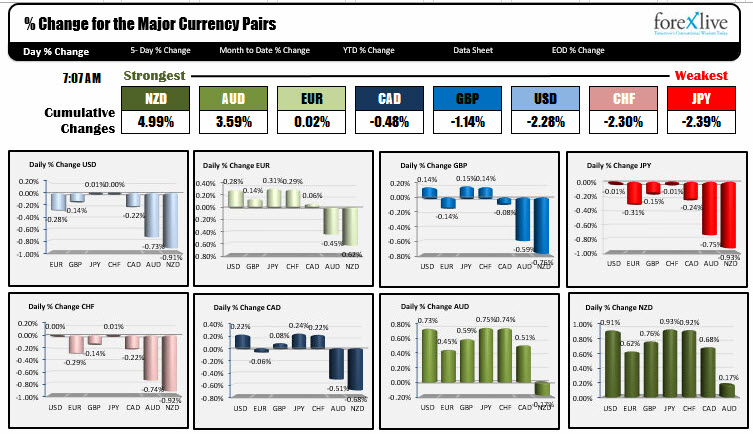

NZD and AUD are the strongest. JPY is the weakest

The NZD and the AUD were both up. The Australian export data (+1.5% vs 1.2% exp) out of Australia was better than expectations and it helped to lift the AUD and the NZD along with it (The AUD GDP is out tomorrow and the data should be supportive). Later, the RBA in their statement did not change their view on the Australian dollar despite a sharp fall in commodity prices and a higher AUD ("The Australian dollar is adjusting to the significant declines in commodity prices."). This helped lead to a continued move higher in the AUD and the NZD rose along with it. The AUDUSD got close to 0.7300 but stalled on the first look.

The JPY weakness was mostly against the AUD and NZD - continueing the upward momentum that was seen in yesterday's trading (SEE POST on NZDJPY here).

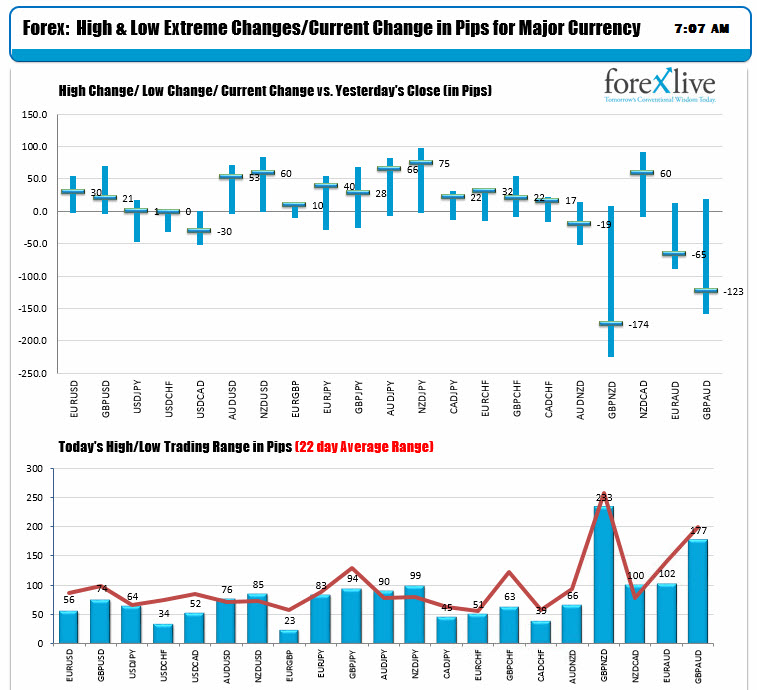

The USD slipped lower with again most of the damage vs the AUD and NZD currencies. It nevertheless is lower vs the EUR (up 30 pips) but is trading off the highs (see chart below). The volatility continues to contract for most of the major currencies. Better PMI data helped the pair to the highs (and above the 1.0600 level), but the price has retreated back a bit.

CAD GDP (0.0 MoM vs +0.1% last and +0.4% YoY, QoQ 2.3% for 3Q) and US ISM Mfg PMI: EST 50.5 vs 50.1 last month are the main data released. There will also be US construction spending (+0.6% est). Feds Evans speaks on the economy at 12:45 PM ET. Auto sales are going for a record (18.2 M pace est).