Deutsche Bank remains constructive on GBP arguing that the M&A boom is a bright spot for GBP

"The flow environment continues to be constructive. BoP data shows large debt inflows over H1. Meanwhile, the UK is the largest beneficiary of this year's global M&A bonanza.

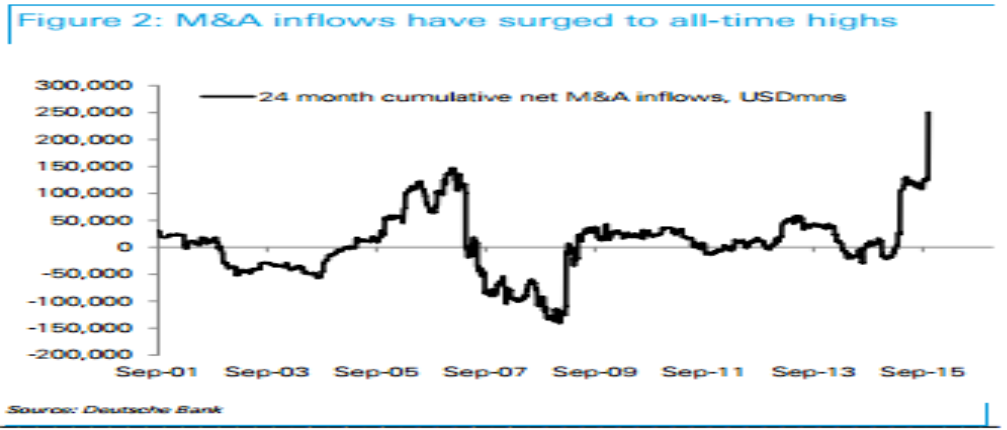

Our latest high frequency Cross Border M&A monitor showed 2yr inflows accelerated to all-time highs of USD 250bn.

The policy drive to attract foreign capital continues, with UK PLC sharpening its sales patter for this week's visit of Chinese premier Xi, a potential 40% stake in the GBP 25bn Hinkley Point power station up for grabs,"DB notes.

For bank trade ideas, check out eFX Plus.