I posted an account of George Soros breaking the Bank of England on the weekend.

The best part is Soros’ steely nerves and willingness to make a huge bet:

According to Mallaby, Druckenmiller noted that their $1.5 billion bet against the the pound was about to pay off and that they should consider adding to the position.

Soros retorted with a different strategy: “Go for the jugular.”

…

And so that morning, Soros and his fund increased their short position against the British pound from $1.5 to $10 billion.

The Bank of England hiked rates to 12% from 10% and then again to 15% but Soros didn’t flinch. Some of you were asking for the charts from Black Wednesday, here they are.

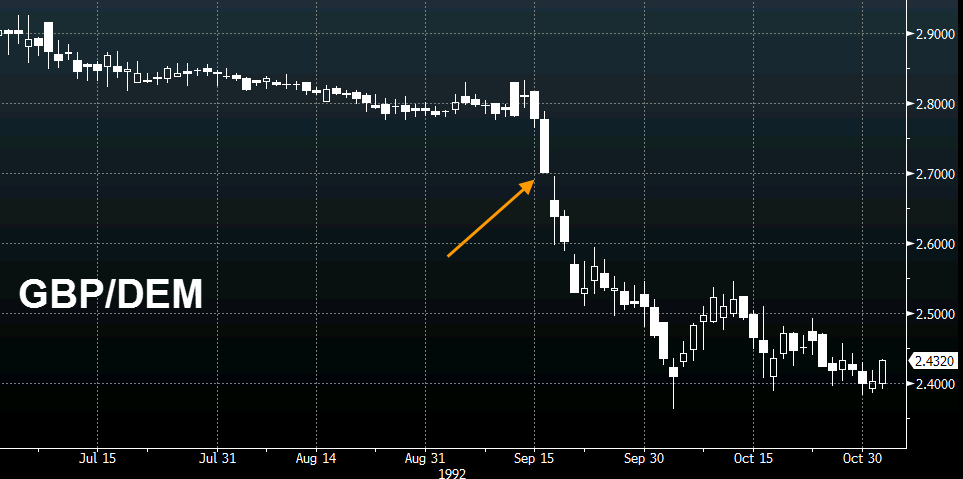

GBP/DEM on Black Wednesday

How does 4500 pips in two months sound?

The pound when Soros bet big

“I’ve learned many things from [George Soros], but perhaps the most significant is that it’s not whether you’re right or wrong, but how much money you make when you’re right and how much you lose when you’re wrong.”

– Stanley Druckenmiller