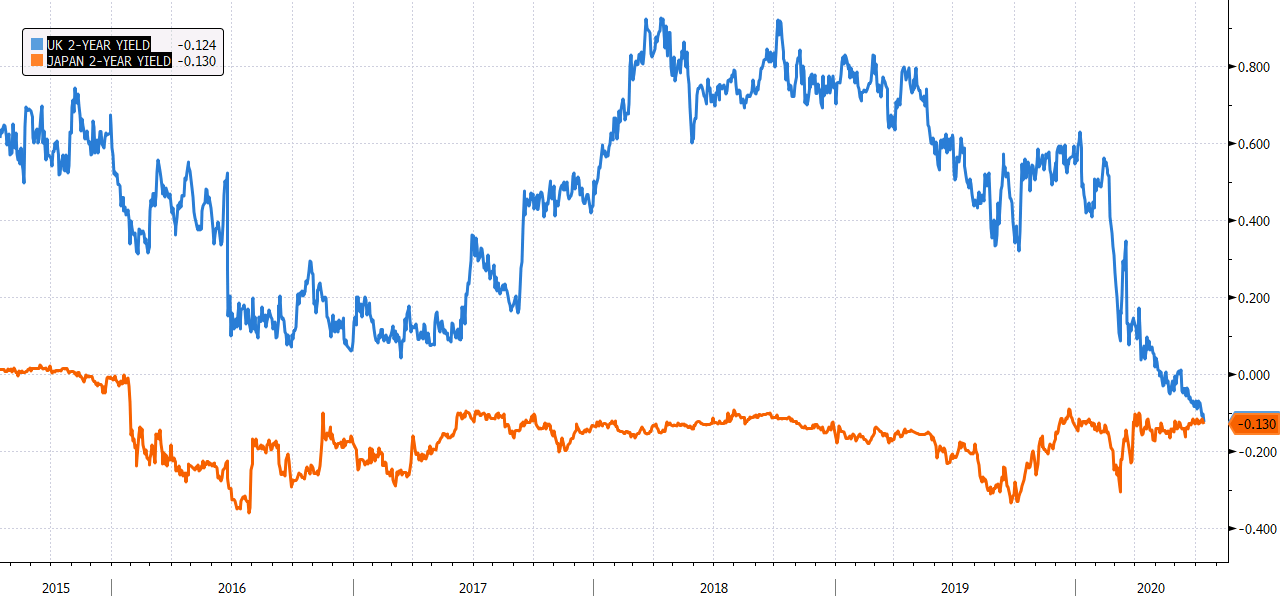

The Japanification of the gilt market continues

Japan is pretty much the benchmark for low-to-no yields in the global bond market and when another country reaches that point, it sort of rings an alarm bell to investors that there isn't much attractiveness/value in said yields anymore.

UK long-term yields fell below their Japanese counterparts at the end of last month but now we're seeing the front-end of the curve follow suit as well.

The rally in gilts could either be suggestive that investors are fine with being more risk averse or that those buying are pretty much stuck due to regulatory constraints.

But whatever the case is, don't expect value investors to be searching for scrumptious returns in the UK any time soon. In turn, that may be another reason to add to the list of headwinds for the pound and the UK economy in general.