US dollar falls from the highs

The November jobs report was yet-another example that the only that matters to the US dollar market is wages.

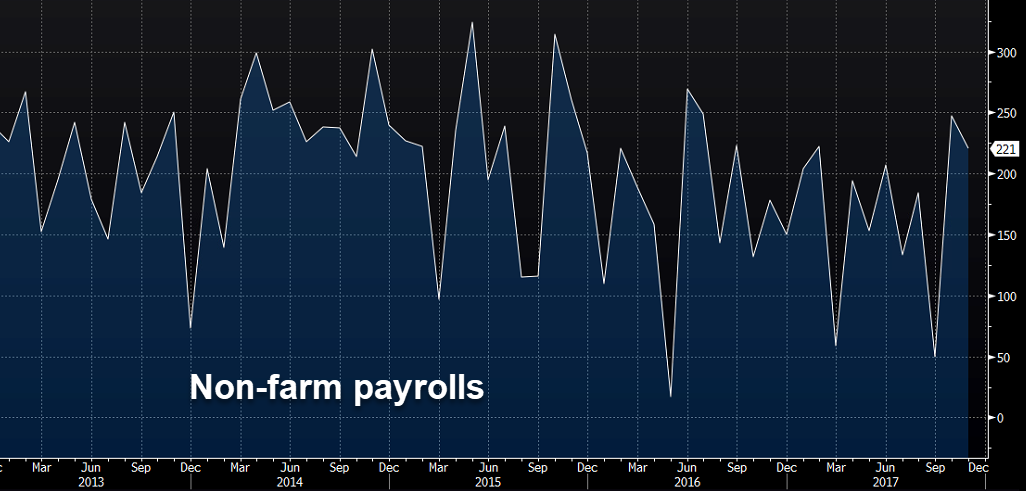

The jobs report was healthy at 221K compared to 195K expected as jobs remain easy to find. The problem remains that good-paying jobs and raises are still elusive.

Average hourly earnings rose just 2.5% y/y, weaker than the 2.7% y/y reading that economists were expecting.

Many at the Fed believe that number will tick higher and up to 3% in the year ahead but they've believed the same thing for many months and the evidence isn't there.

The result has been a dip in the dollar. USD/JPY was trading at 113.50 before the report and ticked down to 113.15 before bouncing to 113.35.

The euro has also recouped some of its earlier losses. EUR/USD strengthened to 1.1765 from 1.1735 on the headlines.

Overall, the moves are modest. The Fed will weigh in on Wednesday when the FOMC is likely to hike rates -- it's 98% priced in -- and could signal what's coming next.

Ultimately, I don't think this report is a game-changer. Jobs growth is still strong so it's going to he tough to bet against the US dollar but it's enough to put the US dollar at a standstill today.

Looking ahead, wholesale inventories and U Mich consumer sentiment are due at 10 am ET. That might shake things up a tad but a better bet from here is watching sentiment in the stock market.