GDP at 1.5% in Q3 vs 1.6% expected

The US dollar fell about a dozen pips as headlines hit showing third quarter GDP fractionally lower than forecast but the dollar quickly recovered.

EUR/USD rose to 1.0974 but couldn't break the high from a few hours earlier and has tracked back down to 1.0948. USD/JPY fell to 120.80 then rebounded to 120.90 with 121.00 offering some light resistance.

Sequential quarterly growth numbers for the US this year have been +0.6%, +3.9% and +1.5%; averaging a tidy 2.0%. This was supposed to be the year of the big recovery but once again it's a two-percent economy.

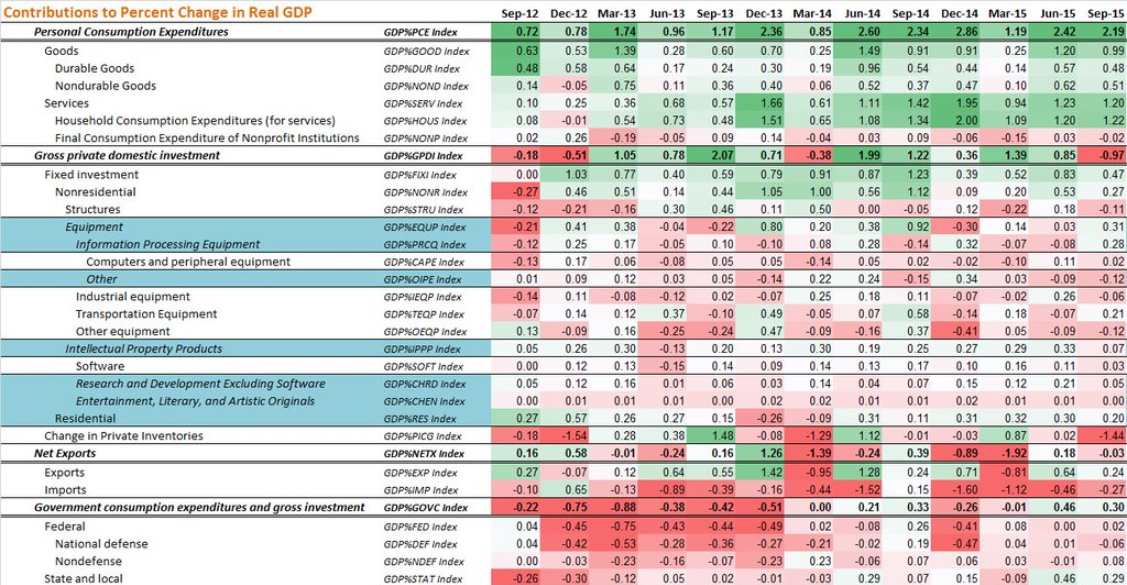

Inventories were a big drag, pulling growth down 1.44 pp. Investment was also soft but net exports were a surprising contributor despite the strong dollar. As usual, consumer spending carried the weight.

There was some thinking that the Fed had seen an early copy of the report and that it would be strong. It was a touch soft but the flows around the Fed are still the driver today.

I expect the market to remain in 'buy-the-USD-dips' mode for the next week.