Dollar continues have a tailwind

The US dollar was the top performer last week and is off to a great start today.

If we go back a post I made on January 9 highlighting the case for dollar strength, nothing has changed. The US is winning the vaccine race and just cleared the main hurdle on the stimulus front.

The daily swing factor at the moment is the bond market. Yields are moving higher again today with US 10s up 3.5 bps to 1.60% today as the spreads over Europe continue to widen (Italian 10s are down 1 bps today).

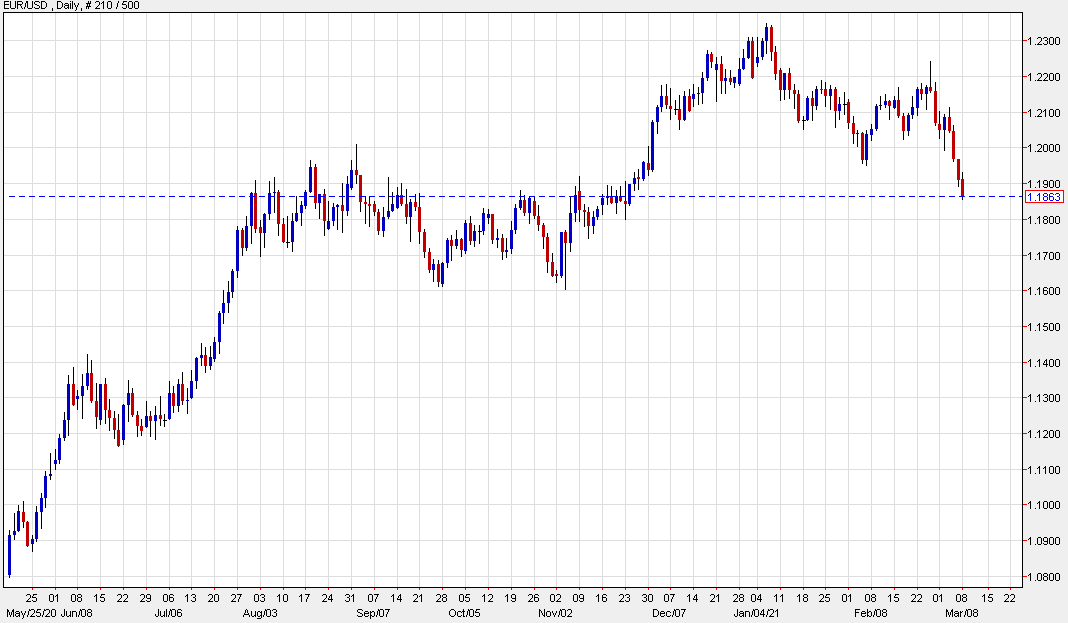

EUR/USD:

I don't see this paradigm changing any time soon, at least against the euro, yen and Swiss franc. The ECB will probably do more this week and that could kick this into another gear.

Meanwhile, the US economic calendar is a total dud today. The only thing we get is the lowly wholesale inventories report at 1500 GMT.