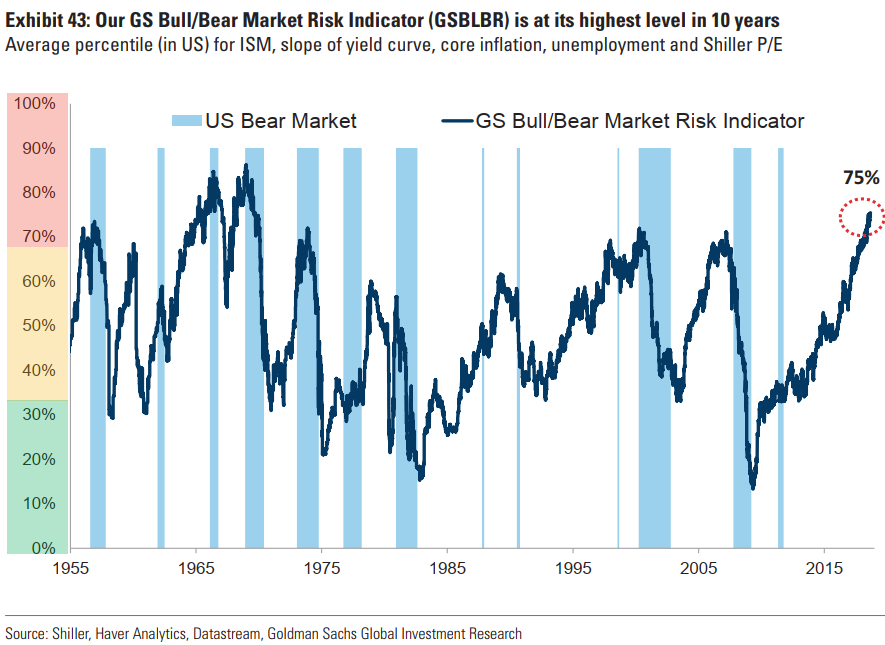

GS is sounding a warning on current levels of US share markets, highlighting "Bull/Bear Market Risk Indicator is at its highest level in 10 years"

The indicator is at levels which have historically preceded a bear market.

It's always risky to argue that this time is different but there are two most likely scenarios when we think of equity returns over the next 3-5 years.

- 1) A cathartic bear market across financial markets. This has been the typical pattern when this indicator has reached such lofty levels in the past. It would be most likely triggered by rising interest rates (and higher inflation), reversing the common factor that has fuelled financial asset valuations and returns over recent years or a sharper than expected decline in growth. Such a bear market could then 're-base' valuations to a level where a new strong recovery cycle can emerge.

- 2) A long period of relatively low returns across financial assets. This would imply a period of low returns without a clear trend in the market.

Equity investors and traders have been hearing such warnings for many years now (amirgihtoramiright?). The BTFD trade has just carried on working, and I dunno the timing on when it'll stop.