Highlights of the January 2016 US non-farm payrolls report:

- Prior was 292K (revised to 262K)

- Private payrolls 158K vs 180K exp

- Manufacturing payrolls +29K vs -2K exp

Wages

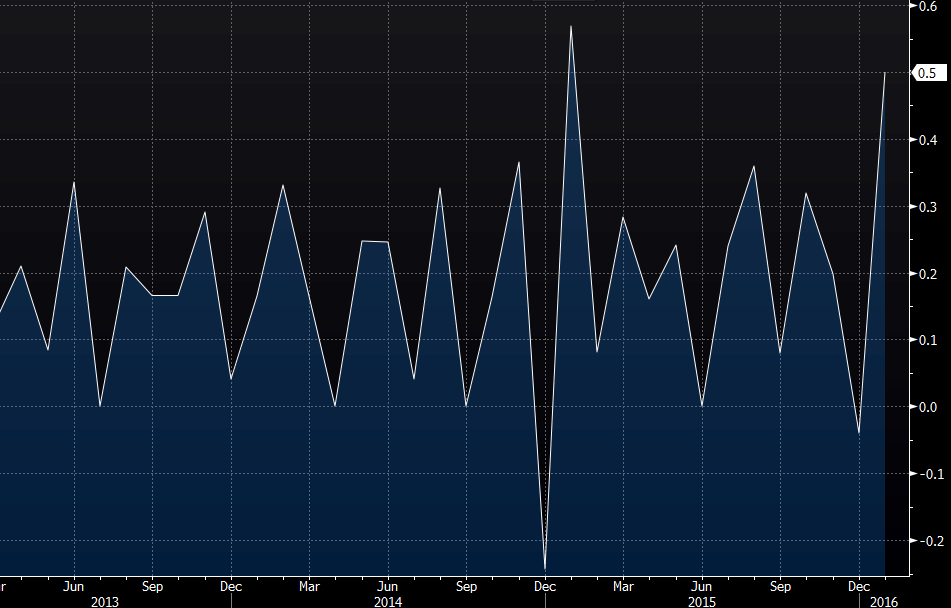

- Avg hourly earnings +0.5% vs +0.3% m/m exp

- Prior avg hourly earnings 0.0% m/m

- Avg hourly earnings 2.5% vs 2.2% y/y

- Prior y/y avg hourly earnings 2.5% (revised to 2.7%)

- Avg hours 34.6 vs 34.5 exp

Employment rate

- Unemployment rate 4.9% vs 5.0% exp

- Prior unemployment 5.0%

- Labor force participation 62.7% vs 62.7% exp

- Prior participation 62.6%

- Underemployment rate 9.9% vs 9.9% expected

The headlines and revision are soft but the wages will overshadow it. Rising wages will confirm the Fed's bias towards inflationary pressures and will keep the Fed from growing less hawkish in March.

The first reaction was a US dollar drop but it quickly recovered and touched higher.

There's an ongoing battle here. Just on the data, my take is that it's good news for the US dollar. The headline number and revisions leave the economy with about 70K fewer jobs than hoped but the drop in the unemployment rate (despite a flat participation rate) shows the economy is perhaps closer to full employment than believed.

The Fed definitely has a bias towards the hawkish side and this will confirm that bias.

I can envision a day in the distant, Japan-like future where average hourly earnings routinely overshadow jobs gained/lost.