MoM for November 0.0% vs. 0.1% est. Core MoM 0.1% vs. 0.1%. Personal spending and Personal income rose by 0.3% each.

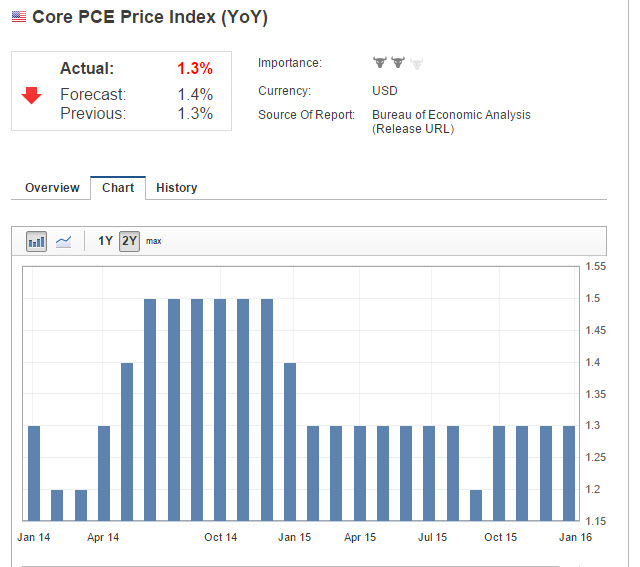

US PCE deflator data came in largely as expected. The YoY measures for the headline and the more relevant core were as exected at +0.4% and 1.3% respectively. The Fed is targeting an inflation rate of 2.0%. Both measures - needless to say - have a ways to go.

Regarding the MoM the headline change for November was less than expected at 0.0% vs.0.1% estimated. The core rose by the expected 0.1%. Once again, not what that Fed wants to see. The PCE has not been at 2% since April 2012.

For personal spending and income for the month of November, Personal income increased by 0.3% for the month vs 0.2% est. while personal spending increased by 0.3% which was the estimate.

The increase in income of 0.3% comes after a 0.4% rise in November. Wages and Salaries increased by 0.5% which came after a 0.6% gain in October. That is good news for future inflation but the rise is not being reflected in the overall PCE data yet.

Spending was helped by a better employment picture, lower gasoline prices and rising home prices (although existing home sales were horrible yesterday).

The savings rate declined to 5.5% from 5.6%. The 5.6% reading last month was the highest in 3-years.