The FOMC meeting minutes portrayed a Fed more concerned about inflation than growth. This has led to the USDJPY tumbling lower. In the process, the technical bias turned more bearish, but be warned that choppy and volatile trading conditions remain. So trade cautiously.

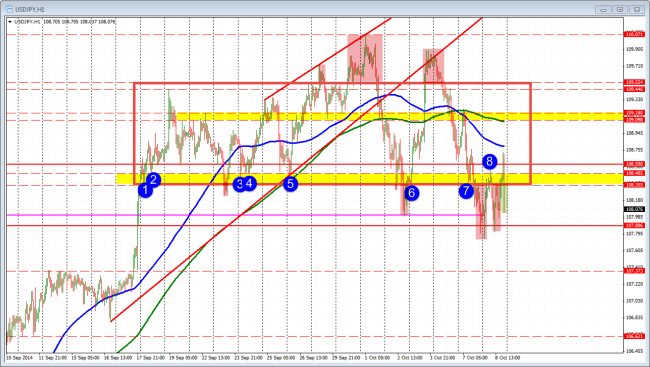

The USDJPY is once again pushing the downside.

The pair is back below the support area outlined by recent lows over the 15 day up and down consolidation (between 108.35 and 109.52). For the pair to move lower, it needs to start to build value below this “Red Box” (see chart above) and stay below this area. The low earlier to day came in at 107.74. The next target on the hourly chart comes in at 107.37.

This road was traveled earlier today and ended when the price moved back above the 107.35 area. The same story is in place, currently.

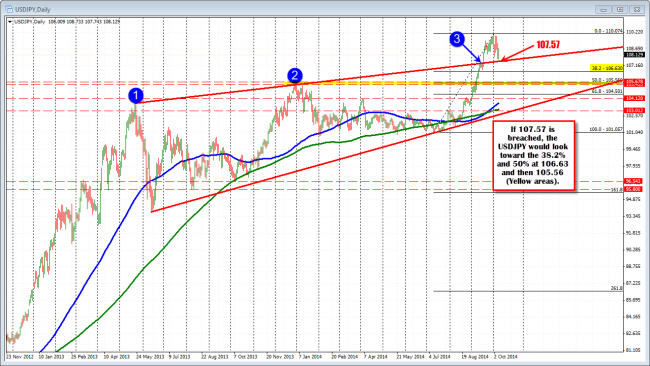

Looking at the daily chart below, there is a broken trend line cutting across highs going back to May 2013 and January 2014 at 107.57. This level was tested before breaking above in September. If the price heads toward this area, and if the price is able to break below, the next key target on the daily will come in at the 106.63. This is the 38.2% of the move up from the July low at 101.057 to the high reached in early October at 110.07.

Care is in order but risk does not have to be great. Be aware (again)

The daily chart for the USDJPY shows support at 107.57 on further selling.