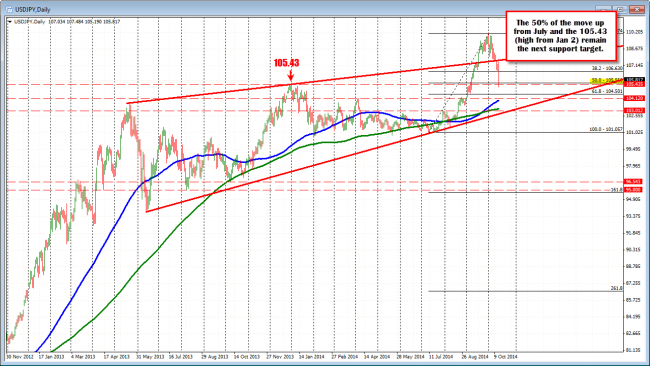

The USDJPY has been keeping the bearish bias as per previous posts. The pair has tested the top support at the 105.56. This is the 50% of the move up from July. The 105.43 is the high price for the year going back to January 2nd and is also support. The low moved to 105.588. The stocks slide is helping to lead to the flight into safety but the forex market is relatively quiet (although GBPUSD is making new lows as I type).

USDJPY daily chart has the next support target at the 105.43-56

The story remains the same for this pair. Stay below the midpoint of the days range at 106.337 (see hourly chart below) keeps the bears in control. A move below the 105.43 and their should be further liquidation. Beige book comes out at 2 PM ET. Traders will be watching for the stories about possible slowing. That seems to be the risk with the stocks under pressure and the fears rising in Bonds as well.

The USDJPY tested the top side of the support area (at 105.56 Low at 105.58.