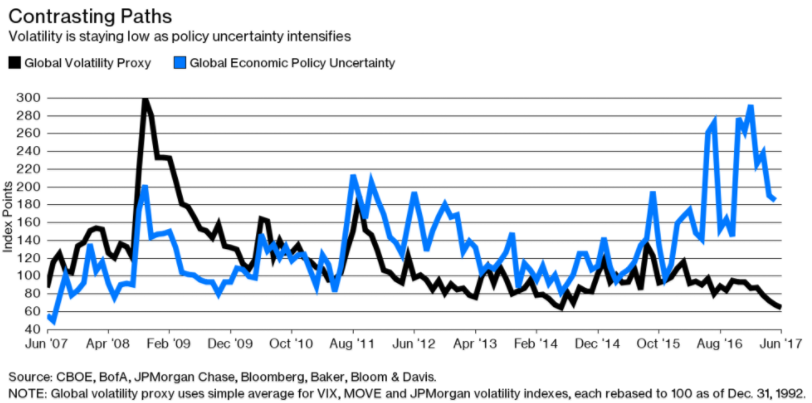

Volatility in markets have been subdued in 2017, and it's affecting trading opportunities

2017 hasn't been short of surprising and unexpected events to say the very least. We have Donald Trump in charge. We have Brexit drama. We have North Korea launching missiles. We have European politics looking shaky.

But among all that, it's failed to boost up volatility in the market as most fund managers and traders look past those events in a flash.

Bloomberg meanwhile puts the blame on central banks, particularly the Fed and ECB, on communicating too well their plans to dial back stimulus - and thus keeping market gyrations at a bare minimum.

Implied volatility on three-month options for the euro has slid to 6.86 percent, near levels not seen since 2014, while dollar-yen volatility has fallen to 8.13 percent.

When you look at the VIX, it's currently trading at its lowest levels over the past year and the trend has been one of a declining and flattening one.

So what does it take to bring back volatility into markets?

Alan Ruskin, global co-head of FX research at Deutsche, says that the key is bond volatility. According to him:

Yields have been suppressed significantly either because of quantitative easing and/or negative rates. Inflation has been on the soft side as well. If any of those things give way, then you start to inject volatility into the bond market and then it will transmit itself outward.

Meanwhile, Thierry Wizman from Macquarie Group says that the US tax reform could likely be the catalyst to spark a little bit of volatility in the market.

What do you think is needed to bring back volatility into the market?

My take is that subdued conditions are likely to continue. There's just too much liquidity in the market right now and that's not going to put off investors from putting their money into something. Everybody wants a piece of the action and everyone's going to play ignorant until something really, really bad happens. Otherwise, people are going to easily shake off anything that's remotely relevant to causing a shake-up in the market.

But in all seriousness, I'd reckon (and prefer) it'll take a Trump-Kim Jong Un arm wrestling match to stir things up. But hey, that's just me.