Canadian growth looks to turn around 4 straight losses

At the bottom of the hour we get the latest growth figures for May. 0.0% is expected from -0.1% prior m/m. If we go negative again that will be the 5th consecutive minus

The data is lagging now that we're at the end of July so it's not really a big deal, but it may give loonie traders some vol if we see a wild variation

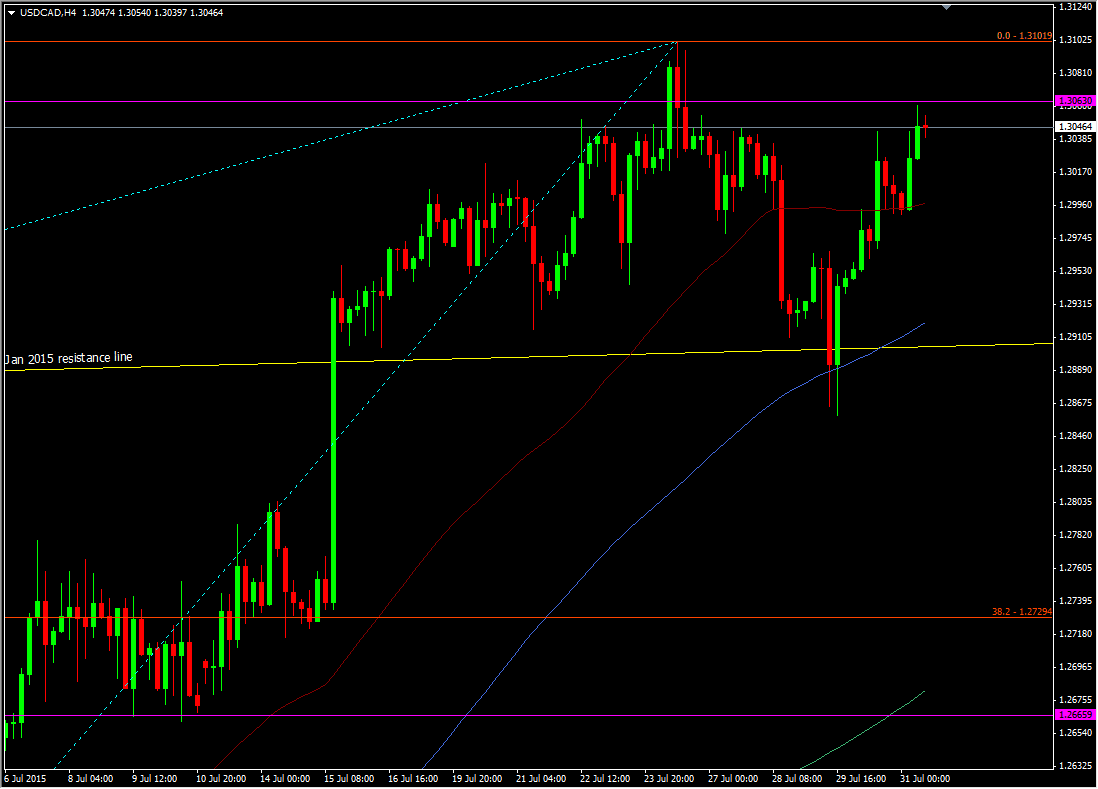

USDCAD H4 chart

We've been up to test the area around the 2008/2009 highs once again and found resistance once more. It's a tough old level so worth some focus.

Oil looks to have been the main driver once again so if GDP release moves the Cad out of sink with the oil correlation then there may be a little opportunity for a quick trade

Also at 12.30 gmt we get the US second quarter employment cost data. It's not usually a great market mover but it holds some sway over the wage picture in the US. Wages came in at 0.7% in Q1 and costs were 0.7% prior