Reports via DJ say Japan's public pension fund has started to hedge a small amount of its investments against currency fluctuations, according to people familiar with the matter.

- Japan's Government Pension Investment Fund

- Has started to hedge against fluctuations in the euro in the "short term"

- Said due to a negative outlook for the currency amid expectations for further easing by the European Central Bank, the people said.

- The fund has not previously hedged any of its roughly ¥ 50 trillion in assets denominated in foreign currencies

- A GPIF official declined to comment on whether the GPIF currently was using currency hedging or not, but said that the fund was ready to use currency hedging if deemed necessary

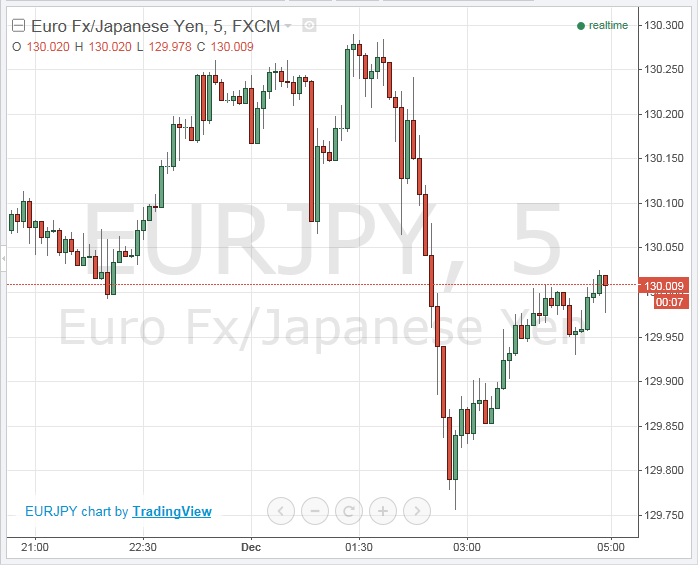

EUR/JPY has been a notable loser on the session: