- Prior month 2.5%(it came in as expected)

- CPI MoM -0.2% vs 0.0% expected.

- Prior MoM +0.4%

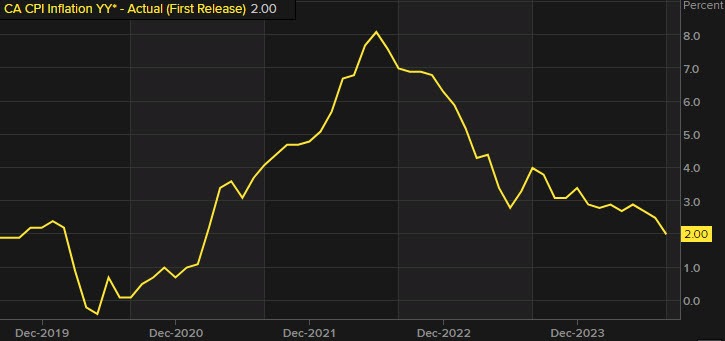

THe YoY of 2.0% is the lowest since March 2021.

Core measures:

- CPI Bank of Canada core YoY 1.5% vs 1.7% last month

- CPI Bank of Canada core MoM -0.1% versus +0.3% last month

- Core CPI MoM SA 0.1% versus 0.1% last month

- Median 2.3% versus 2.2% estimate. Last month 2.4%

- Trim 2.4% versus 2.5% estimate. Last month .7%

- Common 2.0% versus 2.2% last month

The initial reaction is a run to the upside for the USDCAD. The USDCAD went from 1.3590 to the current rate of 1.3610. There is resistance near a swing area between 1.3615 1.3622. The 200 bar moving average on a four hour chart is just above that at 1.3624 in the 38.2% retracement of the move down from the August high is at 1.3633. The price needs to get above all those measures to increase the bullish bias from a technical perspective.

With retail sales in the US at least with the headline moving higher than expected, it puts into question the basis points or 25 basis points at the Fed meeting tomorrow (should be positive for the USD). For the Bank of Canada, inflation is coming down while unemployment is going higher (6.6% unemployment rate was the highest ex the Covid period, since 2017).

There is a 48% of 50 bps cut at the October meeting now and that may/should go even higher. Get above the aforementioned levels and the door opens for more upside in the USDCAD with the 100 day MA at 1.36704 the next HIGHER target.

Other details from the report:

- The deceleration in headline inflation in August was due, in part, to lower prices for gasoline, due to a combination of lower prices and a base-year effect. Excluding gasoline, the CPI rose 2.2% in August, down from 2.5% in July.

- Mortgage interest cost and rent remained the largest contributors to the increase in the CPI in August.

- The monthly decline was led by lower prices for air transportation, gasoline, clothing and footwear and travel tours

- At the national level, prices for electricity fell at a faster pace year over year in August (-1.7%) compared with July (-0.8%). The larger decline was due to a base-year effect in electricity prices in Alberta, following high summer demand in August 2023..

- On a year-over-year basis, consumers paid 2.4% more for food purchased from stores in August after a 2.1% increase in July. This was the result of a base-year effect, notably coming from prices for dairy products (+3.3%) and fresh fruit (+1.5%).

- Prices for clothing and footwear declined 0.6% on a month-over-month basis in August. A drop in prices in the month of August has not been observed since 1971, as this month is typically associated with back-to-school clothes shopping, with stronger demand putting upward pressure on prices. Compared with August 2023, retailers offered more and larger discounts in August 2024 to entice consumer spending amid recent slowing demand.

The changes in major categories showed declines in:

- household operations, furnishings and equipment

- clothing and footwear

- transportation

- recreation, education, and reading

Gains in prices were in

- food

- shelter

- health and personal care

- alcohol beverages, tobacco products and recreation cannabis

For the full report CLICK HERE