RBC is out with its latest Canadian spending tracker and it shows a second consecutive month of weakness in retail spending ex-autos.

Discretionary services spending has softened in four of the past five months with hotels particularly soft for months and restaurant spending sagging in January. More broadly, weakness in grocery spending and clothing sales more than offset gains in other categories like gasoline and furniture sales.

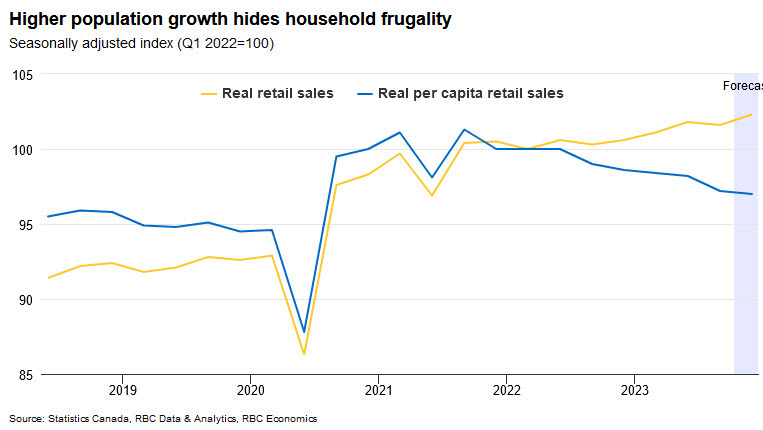

Adjusting for inflation and population, the picture truly darkens. Real per capita retail sales (excluding autos) have declined for six consecutive quarters as of Q4.

The market is treating the Bank of Canada and Federal Reserve similarly but there is much more weakness under the surface in Canada and that's a good reason why today's USD/CAD breakout will last.