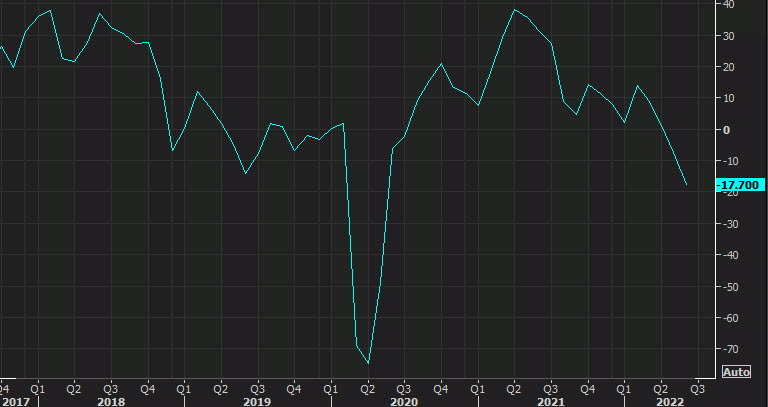

- Prior was -7.3

- Output index +2.3 vs +18.8 prior

- Employment +15.2 vs +20.9 prior

- New orders -7.3 vs +3.2 prior

- Unfilled orders -8.8 vs +4.1 prior

- Prices paid +57.5 vs +61.8 prior

- Prices received +33.8 vs +41.8

Selected comments:

- Business continues to be strong both in terms of sales and margins. There is uncertainty around the 6–12-month outlook.

- Inflation is continuing on anything that relates to oil and gas prices; i.e., almost everything we buy.

- The supply chain is a nightmare, while prices are increasing. It’s difficult to find employees, and the ones we can find are expecting more pay.

- We are starting to see things cooling across all markets except auto. The first area was handset/personal computers, and it’s now spreading to other markets. I would not say things have rolled over, but expedites have stopped, and in-quarter orders have slowed to a trickle. There are clear signs of early cooling beginning. Auto continues to be strong, even though there are definite signs of significant component build within their supply chain. (Computer and Electronic Product Manufacturing)

- Our manufacturing facility is continuing to see unsustainable increases and lead times for raw materials. Skilled labor is a rarity to find. We have increased our starting pay by 40 percent, which puts us above our nearest competitors, and we offer competitive benefits, yet we still cannot attract the personnel needed.

- As a manufacturer of a wide range of products from home goods to medical goods to automotive goods, we have seen a sharp decrease in demand across all sectors. Raw material vendors’ cost increases happen weekly and at a rate that is difficult for us to even update our bill of materials and pass on the price increase to our customers

- We are very concerned about inflation and its effects on stocks, bonds and interest rates. It looks like a recession is on its way. The future does not look good for housing. We are expecting a major slowdown due to material cost, labor cost and mortgage rates. (wood product manufacturing)

- Orders are trending down, and with the Federal Reserve continuing to tighten, we think the six-month outlook for a recession is strong. Current orders and projections back this up. (paper manufacturing)

- Supplies of raw materials are becoming slightly easier to get, with prices moderating because metal commodity markets are moderating. In the last 30 days, it has been slightly easier to hire employees. Business levels/volumes are decreasing. The number of hours worked by employees has been decreased to 40—no additional shifts needed. Please do not raise interest rates again to see how a 0.75 percent increase affects the economy. It seems illogical to me to that the only way to stop runaway inflation is to initiate a recession through monetary policy.

There's plenty of political griping in the comments and I fear that many surveys (esp Michigan) are polluted by ideology and we're not getting clean reads on real business conditions. Then again, is it really a surprise that surveys are politicized in a world where everything is politicized?