Dallas Fed manufacturing

- Prior was -14.5

Details:

- General business activity -19.4 vs -14.5 prior

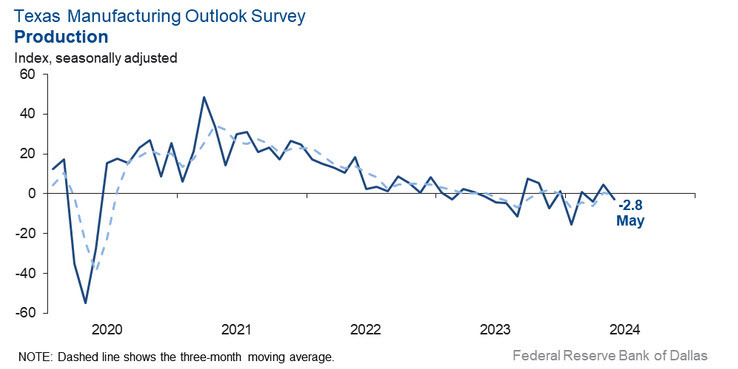

- Output -2.8 vs +4.8 prior

- Prices paid +20.4 vs +11.2 prior

- New orders -2.2 vs -5.3 prior

- Shipments -3.0 vs +5.0 prior

- Employment -5.3 vs -0.1 prior

There has been a slowdown in oil and gas drilling in Texas so some of the drop could reflect that.

Food manufacturing

- Recent developments in the overall economy suggest consumers are resilient and still spending money. Though the Federal Reserve is unlikely to lower interest rates any time soon, the market seems to have adjusted to the delay. Inflation will continue to decline, slowly.

- Volume of new orders has picked up. Demand feels more robust right now than at the beginning of the year. We are still battling cost inflation on raw materials.

- We are still trying to find competent people who want to work. The biggest problem is turnover of new hires. Long-term employees are stable. Young people do not want to work.

Paper manufacturing

- Orders are down approximately 10 percent.

Printing and related support activities

- We have been very busy and having “hooray” billing months with very nice profits, but that is about to change as things seem to be slowing down, and we can tell that this may be a lean summer. We are fortunate to have some nice projects to carry us through the summer and help cover overhead, but we need additional work to make it be profitable. Our competitors have been really slow, so this does not bode well for our next few months.

Primary metal manufacturing

- Our building and construction business remains off. Higher mortgage rates and higher home costs are the main factors. Fewer folks are buying first-time homes. More younger couples are moving into apartments.

Fabricated metal product manufacturing

- Things seem to be slowing down in our manufacturing sector.

- We have orders, but jobs are not being released due to financing holds and uncertainty.

Machinery manufacturing

- Business is flat at a relatively low level.

- It isn’t much fun to be in business right now, at least in our industry. Our sales team is putting forth a full-court press effort, and we've attempted to add services and product offerings to complement what we do, but it's just tough sledding and has been all year.

Computer and electronic product manufacturing

- We are reaching a cyclical bottom for most end markets after the post-COVID inventory build. We are expecting shipments to more closely follow end-market demand in the second half of 2024.

- Customer volumes are decreasing due to the economy. They are still bullish, but indicators based on outbound shipments show there will be fewer shipments in the future. Technology changes with AI [artificial intelligence] have increased technology deployment and are possibly going to increase production, but it's too early to be a contribution to growth in the next six to 12 months.

- Wage inflation continues to be our biggest issue. We are caught between a rock and a hard place; we have to increase wages to keep our best employees, but we also have to invest capital to improve productivity so we can eventually do more with fewer people. The combined result is substantially less free cash flow for this year and next. The tax increases that President Biden has announced as part of his reelection campaign will have a very significant negative impact on our ability to grow. We will be forced to slow down capital investment and reduce head count if he is reelected.

Transportation equipment manufacturing

- Things are in a mess.