- US April consumer credit outstanding +38.07B vs +35.0B expected

- WTI crude oil settles at $119.41

- White House says tariff relief is on the table to combat inflation

- Video: The message from the falling yen and what to expect from the ECB

- EIA sees faster US oil production growth

- European equity close: Late rebound mitigates the damage

- New Zealand GDT price index +1.5%

- Canada May Ivey PMI 72.0 vs 66.3 prior

- World Bank lowers 2022 global GDP forecast to 2.9% from 4.1%

- US international trade balance for April -$87.1B vs -$89.5B estimate

- Canada April trade balance +1.50B vs +2.90B expected

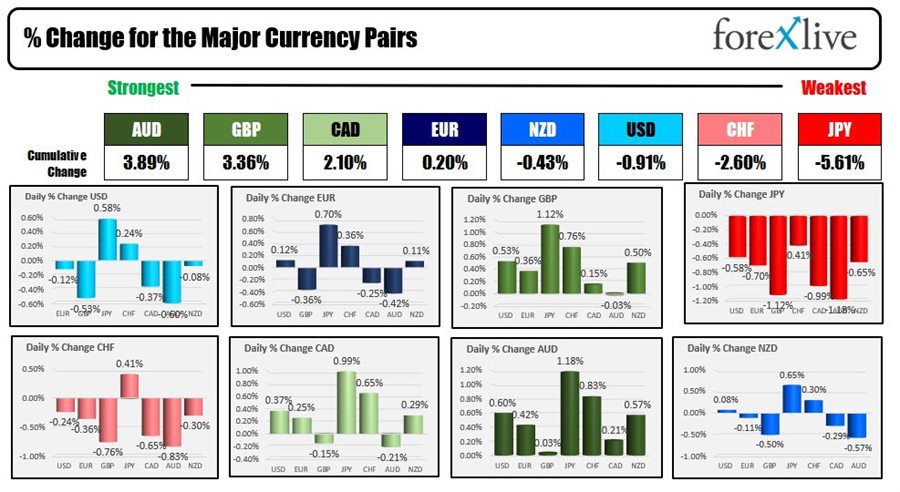

- The USD is the strongest and the NZD is the weakest as the NA session begins

- ForexLive European FX news wrap: Dollar holds firmer, RBA hikes by 50 bps

Retail giant Target said that it was racheting down earnings forecast due to an unwanted buildup in inventories. However, it also said it hoped to rebound after the process. The company ordered too many goods. The economy is shifting to more services vs goods. The supply chain is not as smooth from production all the way to delivery.

The markets took that news poorly at first with

- the US stocks moving lower in pre-market trading.

- US yields meanwhile came off high levels at the start of the US session but were trading just below unchanged on the day

- The dollar was the strongest of the major currencies.

More specifically, in the forex, the EURUSD was breaking to the the lows at 1.0651. The USDJPY was off it's highs for the day but still only near the 38.2% of the day's move to the upside. The USDCHF was at new highs at 0.9777 (and highest level since May 19). The GBPUISD had successfully tested the 100 hour moving average at 1.2533 on a corrective move higher in the London session, and was moving back down toward the 38.2% retracement of the range since May 13 at 1.24705. The low reached 1.2485.

However after stocks opened and started to move higher. Yields started to move lower and with it the dollar also moved lower.

Traders were perhaps shifting the Target news from a earnings problem, toward the potential for low inflation as unwanted inventories of goods leads to markdowns and prices which leads to lower CPI, which leads to lower rates, and higher stocks, on less Fed tightenings. That is the theory at least.

In the US debt market, 10 year yields moved back lower and are trading at 2.977%, down -6.1 basis points. The high yield reached 3.062%. The 30 year yield fell -6.5 basis points to 3.126% after it's high yield reached 3.208%. The 3 year yield is at 2.914%, down -2.5 basis points despite a less than stellar 3 year auction.

In the US equity market,

- The Dow industrial average was down as much as -273.93 points at the session lows. It closed up 264.36 points or 0.8%.

- The S&P index was down -42.11 points or -1.02% at session lows. It closed up 38.67 points or 0.94%

- the NASDAQ index was down -172.75 points or -1.43% before closing up 113.87 points or 0.94%

In the forex, the US dollar went from the strongest of the majors to mostly lower against the major currencies. The exceptions were against the USDJPY and the USDCHF - the two countries that are still reluctant to tighten, and traditional safe haven currencies. The USD was the weakest vs the AUD.

For the AUDUSD, the pair surged to the upside to 0.72449 after the Reserve Bank of Australia raised rates by a greater than expected 50 basis points, but gave up all those gains and traded to new session lows in the early US session (the low price reached 0.7156).

However as the markets "turned the him beat around" with the dollar moving lower, the AUDUSD led the way to the upside (lower dollar) and is closing back above its 100 day moving average at 0.7226. In the new trading day getting above the 200 day moving average at 0.7255 will be the next upside target

The GBPUSD also found a strong bid after it moved back above its 100 hour moving average at 1.2527. The run to the upside also saw the pair moved the price back above the 200 hour moving average at 1.2570, before slowing the rise at the high for the day at 1.2599. The price of the GBPUSD never traded back below its 200 hour moving average at 1.2570. That level will now be close support in the new trading day.

For the EURUSD, as mentioned it traded as low as 1.0651 early in the New York session, but rallied up to between the 100 hour moving average at 1.0706 and 200 hour moving average 1.07197. Those moving averages will be the barometer in the new trading day for this currency pair.

The USDJPY traded to yet another 20 year high near 1.3300, but backed off. The correction off the high reached down to 1.3230 before bouncing back up toward 1.3262 at the close. Although off the highs, the price is still closing solidly higher on the day (+77 pips).

In other markets as the US traders look to exit:

- Spot gold is trading up $12 or 0.66% at $1852.52

- Spot silver is trading up $0.10 or 0.46% at $22.22

- Crude oil is trading up $1.10 at $119.62. A move down to a low of $117.14 before bouncing back up over $120 in less than an hour. The price has tapered off a bit to back below $120

- Bitcoin also had a volatile run move down to $29,184 before bouncing back higher to $31,536.

Good fortune with your trading. Thank you for your support.