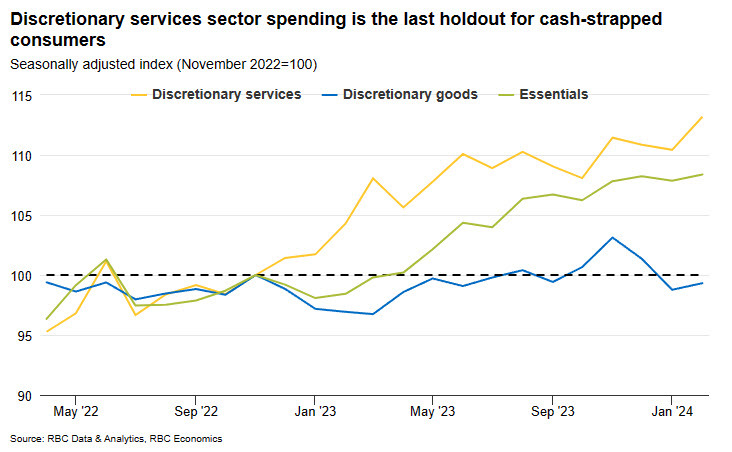

RBC released its latest Canadian consumer spending tracking data on Friday and it paints a mixed picture. The numbers are based on RBC's credit card data and shows a decline in nominal sales but better services spending.

- Hotel spending in Feb marked its first uptick in six months

- Restaurant spending continues to be weak

- Spending on essentials is holding steady

- Spending in discretionary goods categories like clothing and footwear has been sagging

- Spending on home improvement has been flat

Some commentary:

Weaker housing affordability has cut into household purchasing power in a big way. Softness in Canada’s job market adds to the pressure. Later this year, we expect stronger services sector consumption will drive the rebound in growth, but this is contingent on the BOC pivoting to cuts by mid-year.

For me, there's no cliff here and that's a reason for the Bank of Canada to take its time but I wouldn't count on that lasting indefinitely, there's some real pain out there.