WTI crude oil settled at $89.01, up 47 cents on the day.

That's a win for the bulls but certainly not the kind of bounce they were hoping for after yesteday's breakdown below $90. It wasn't all bad news though as crude showed some life after a drop to as low as $87.01.

On the fundamental side, the strong US jobs report undermines the idea that a recession will sap oil demand. The US added 528,000 jobs in July, more than double what economists were expecting.

Still, it was one of the worst weeks for oil this year. It fell $10 from last Friday's close and is now up just $10 on the year. Technically, the daily and weekly closes were below a series of March/April lows. The period of consolidation over most of the year has now resolved lower.

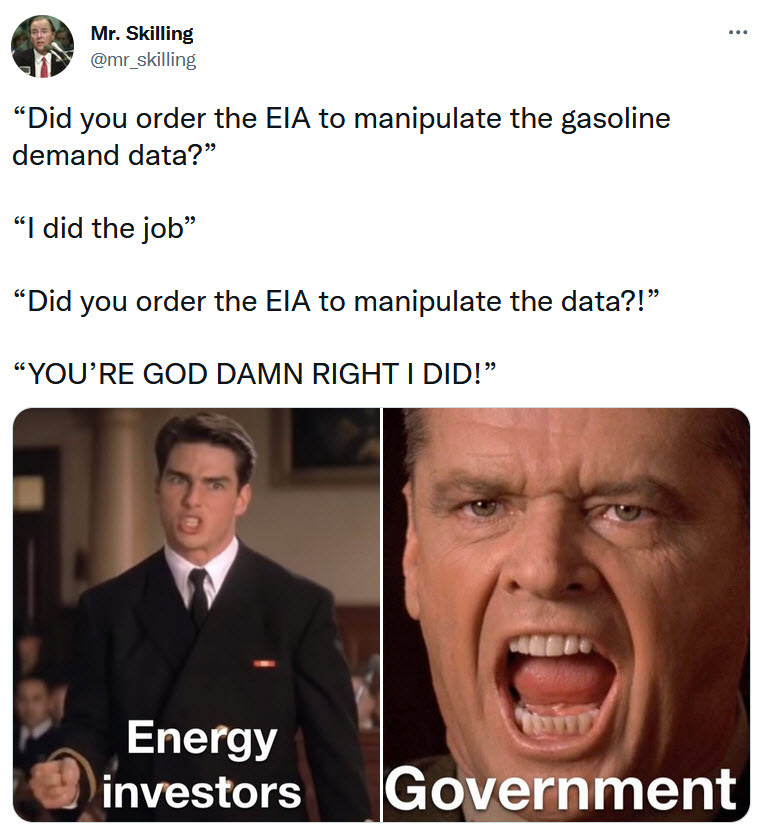

The open question in the week ahead is what is going on with US gasoline demand. I wrote about it here: The data that's driving the rout in oil prices is barely believable. It's something that oil bulls are talking about non-stop and even made its way to ZeroHedge.