Yesterday, Cleveland Fed President Loretta Mester said that she wants to see a few months of falling inflation before pausing rate hikes. A big test will come with the July data on Wedesday. That report will set the tone for next week's trading and is a major risk for the US dollar and equity markets.

The consensus right now is +0.2% m/m and +8.7% y/y. The prior y/y number was a cyce high at an eye-watering 9.1%.

RBC casts the report as a battle of falling energy prices and rising prices of most other things.

"The dip [in CPI] will likely reflect an easing in gasoline price growth on lower oil prices. By contrast, the year-over-year growth in food prices probably didn’t change much, with core (ex-food & energy) prices edging a bit higher compared to a year ago. Broader measures of price inflation are still very high. Over 70% of items in the consumer basket (excluding shelter) were growing faster than 3% in June," they wrote.

US gasoline prices have fallen for 50 days straight and that will mean a roughly 10% decline m/m in July with a similar decline coming into focus for August.

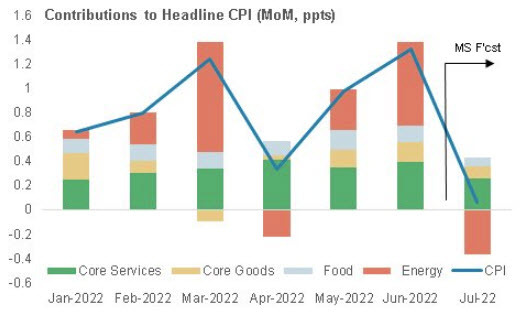

JPM offers this chart to demonstrate the drag on headline inflation from gasoline.

Many firms are shaping their estimates right now so the consensus may shift over the weekend. The range right now is 0.0% to +0.4% on the m/m figure. It's 8.5%-9.0% on the y/y data point.

Looking ahead, there are sign peak inflation but the wage growth in today's non-farm payrolls report is a warning sign that even a dip may only lower CPI to 5% from 9%. That would mean a much tougher round of Fed hikes, well above the 3.62% peak that the Fed funds market is currently anticipating.

From RBC:

There are reasons to believe that inflation will continue to slow. Global supply chain pressures have eased more sustainably since late spring, as shipping times and costs fall. Commodity prices, though very high, have also been trending lower. And with high inflation and rising borrowing costs squeezing consumers’ real buying power, there are already early signs of slowing domestic consumer demand. Goods purchases in volume terms have fallen in recent months, to 3% below levels a year ago in June.