Economic forecasting isn't easy.

At various points over the last two years it looked like the US was slowing down dramatically. At the start of 2023, a looming recession call was the consensus forecast. This year, as some economic indicators deteriorated, those calls returned.

It was understandable -- high interest rates hurt the economy.

In some ways, it was a recession. The manufacturing sector has struggled for many months. Anything housing-related is undoubtedly in a recession. Dollar stores have been wilting under the pain and the lowest quintile is very likely in a recession.

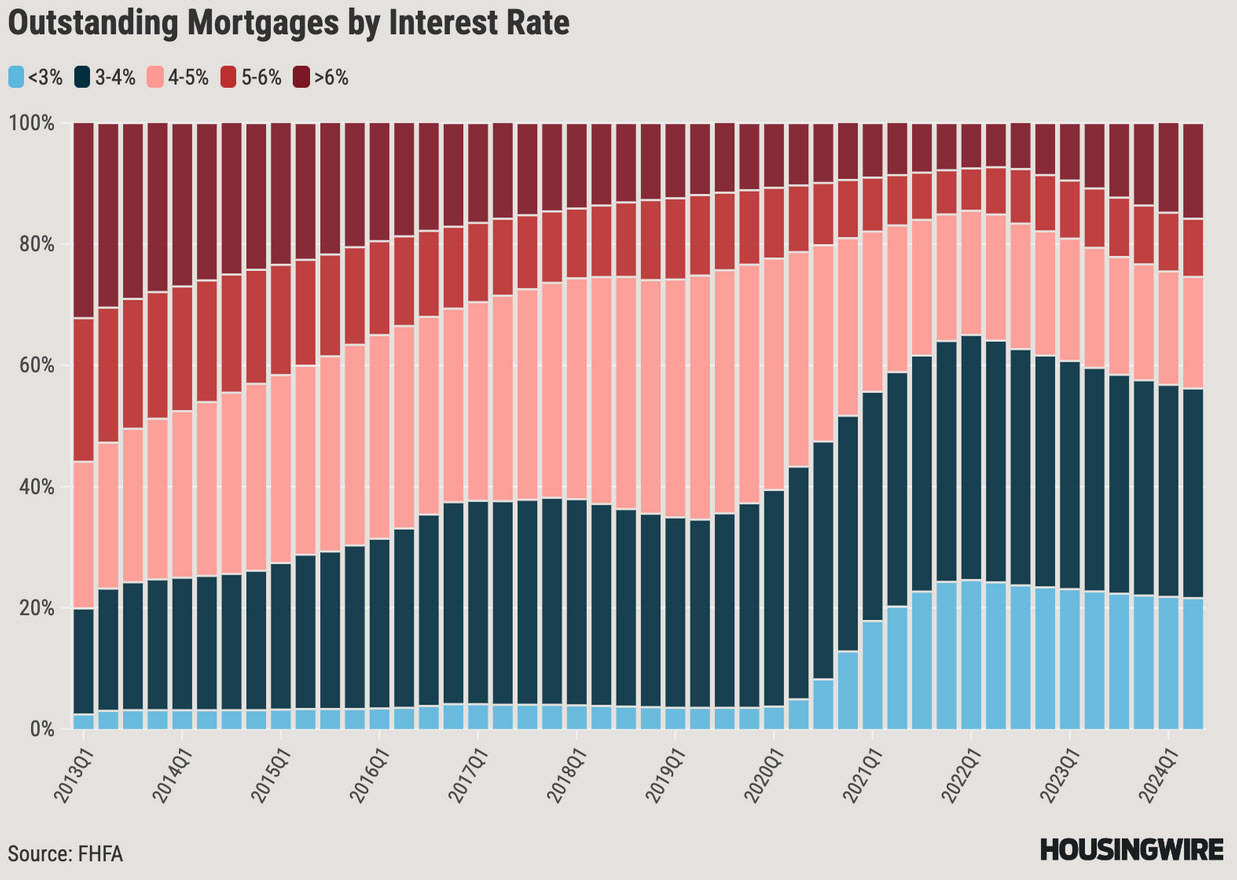

Against that, the power of 30-year fixed rates continues to lift to spending. The US is also benefiting from massive amounts of fiscal stimulus at 7% of GDP and stock markets are ripping on an AI investment boom. I fear what will happen when the fiscal tap runs dry. The 30-year fixed is also fading with 16% of all mortgages now at a rate greater than 6%, according to Housingwire.

For me, the turning point in the outlook (and it's easier in hindsight) was the Wal-Mart earnings report. It's something I wrote about extensively as it's a company that has better data than anyone.

"So far, we aren't experiencing a weaker consumer overall," said CEO Doug McMillon.

The Fed is right to be dovish because inflation is heading lower and 5% rates are unnecessary now but Powell looks like he has a great shot to nail a soft landing. I don't think it's time to worry about a resurgence in inflation just yet but that might depend on how hard China stimulates.