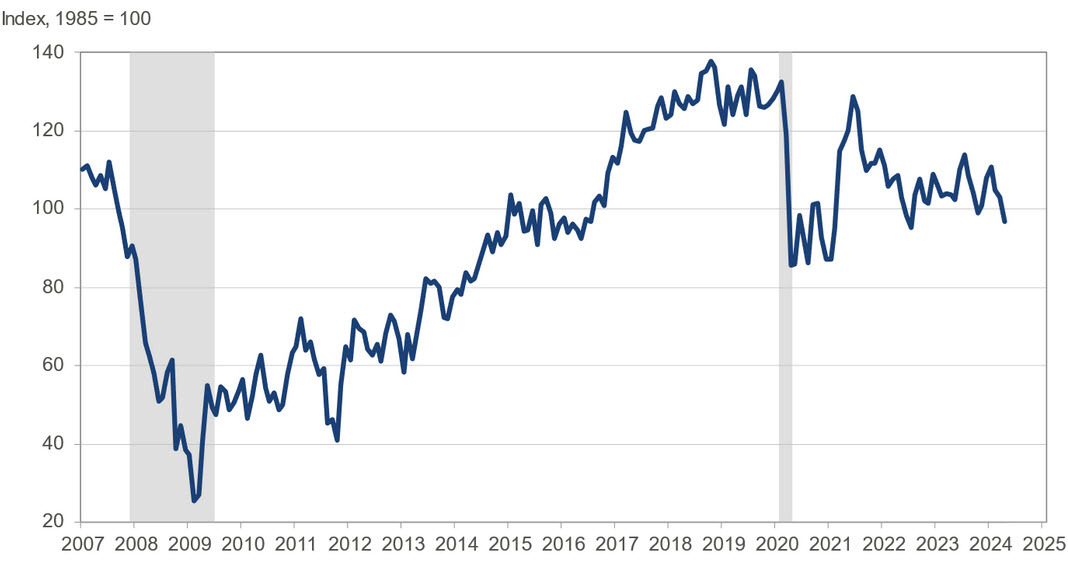

- Weakest since Feb 2021

- Prior was 104.7 (revised to 103.1)

Details:

- Present situation index 142.9 vs 151.0 prior (revised to 146.8)

- Expectations index 66.4 vs 73.8 prior (revised to 74.0)

- Jobs hard-to-get 14.9 vs 10.9 prior

- 15.4% of consumers expect their incomes to increase, from 17.3% last month

This is a big surprise. Unlike the wage data from earlier today, this is forward-looking and correlates with the weaker S&P PMIs from last week. Later this week, we get the ISM services index and that's going to be another interesting one to watch on the survey front.

“Confidence retreated further in April, reaching its lowest level since July 2022 as consumers became less positive about the current labor market situation, and more concerned about future business conditions, job availability, and income,” said Dana M. Peterson, Chief Economist at The Conference Board. “Despite April’s dip in the overall index, since mid-2022, optimism about the present situation continues to more than offset concerns about the future.... According to April’s write-in responses, elevated price levels, especially for food and gas, dominated consumer’s concerns, with politics and global conflicts as distant runners-up."

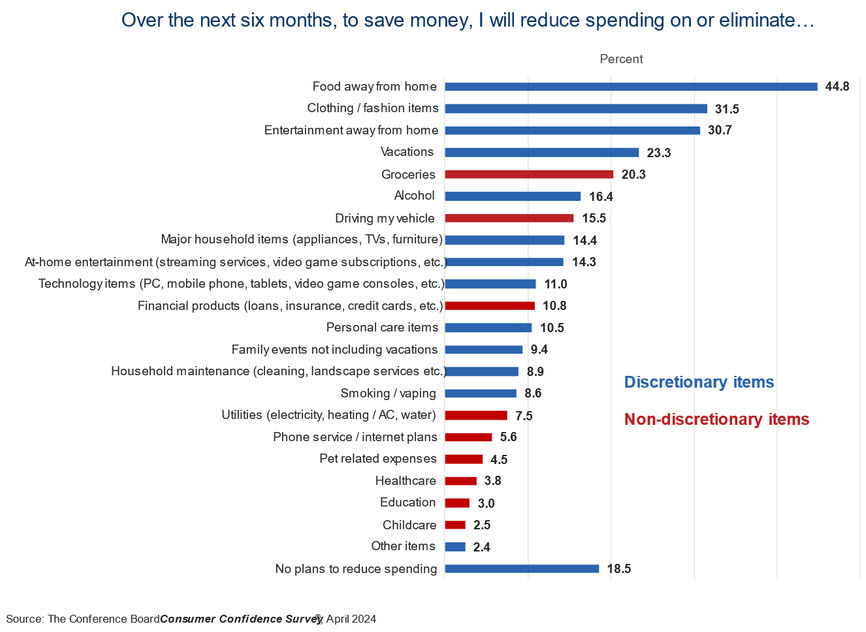

This was an interesting supplemental survey, with consumers balking at high restaurant prices.

McDonald's today also heavily noted macro headwinds.