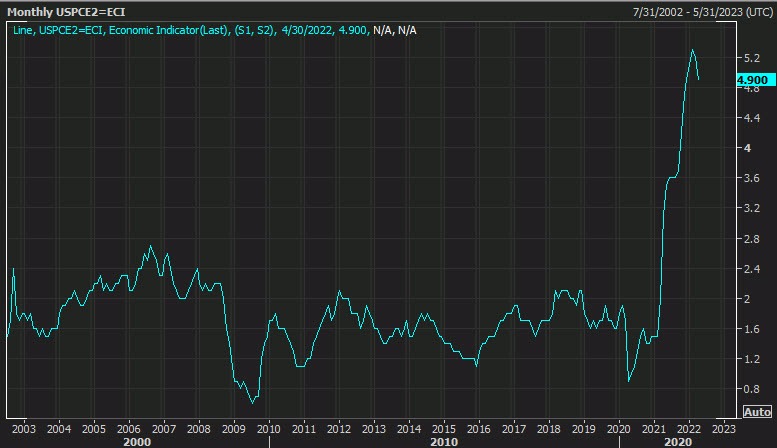

US core PCE for April dips to 4.9%

- Prior was 5.2% YoY

- PCE core YoY 4.9% vs 4.9% estimate

- PCE core (ex food and energy) MoM 0.3% vs 0.3% expected

- Prior MoM core 0.9%

- Headline PCE YoY 6.3% vs 6.6% last month

- Headline PCE MoM 0.2% vs 0.9% last month

Consumer spending and income for April:

- personal income 0.4% vs. 0.5% estimate

- personal spending 0.9% vs 0.7% estimate

- savings rate fell to 4.4%. That was the lowest since 2008

The market can breathe a sigh of relief on the inflation front. The savings rate falling to 4.4% may be a concern for spending going forward but is good news for inflation as well.

According to the BAE:

- The increase in personal income in April primarily reflected an increase in compensation and personal income receipts on assets that were partly offset by a decrease in proprietors' income. Within compensation, the increase reflected increases in both private and government wages and salaries. The increase in personal income receipts on assets was led by personal dividend income. The decrease in proprietors' income was led by nonfarm income.

- The 0.9% increase in current-dollar PCE in April reflected an increase of $48.6 billion in spending for goods and a $103.7 billion increase in spending for services. Within goods, increases were widespread across all components except for gasoline and other energy goods; spending for motor vehicles and parts was the leading contributor to the increase. Within services, increases were also widespread across all components, led by food services and accommodations as well as housing and utilities.

- The PCE price index for April increased 6.3 percent from one year ago, reflecting increases in both goods and services . Energy prices increased 30.4 percent while food prices increased 10.0 percent. Excluding food and energy, the PCE price index for April increased 4.9 percent from one year ago.