- Prior was -23.2

- New orders -22.7 vs - 28.2 prior

- Employment -0.2 vs -10.3 prior

- Avg workweek -8.4 vs -3.2 prior

- Capex -5.4 vs -3.8 prior -- lowest since March 2009

- Prices paid +8.2 vs +23.5 prior

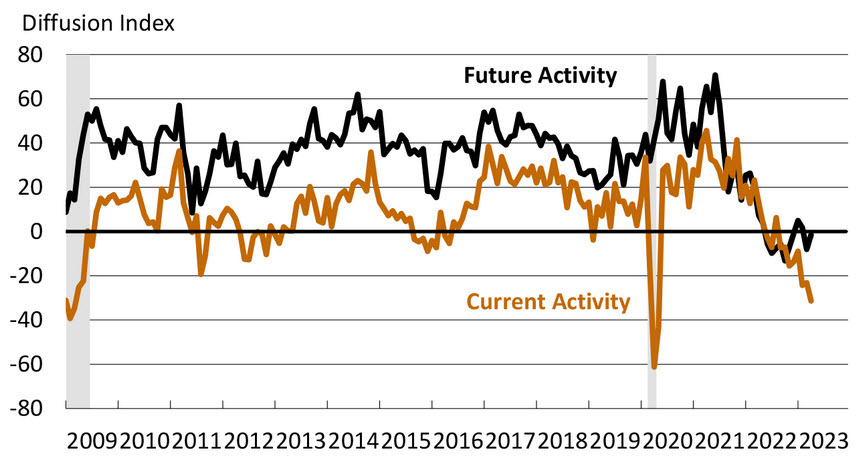

- Future activity -1.5 vs -8.0 prior

- Delivery times -25.0 vs -24.3 prior

- Unfilled orders -11.1 vs -21.3 prior

- Full report

The pricing numbers continue to plunge. Almost 19 percent of the firms reported increases in input prices, while 10 percent reported decreases; 70 percent of the firms reported no change.The prices received index also fell 11 points to -3.3, which is the first negative reading since May 2020.

It's increasingly clear that inflation is on a downward path while Fed hikes are biting into demand, yet the Fed is still hiking rates. Given that, the market's attention is increasingly on growth, rather than inflation . The fear is that the Fed won't be responsive enough and that will lead to an unduly-harsh recession.

In special questions about wages and compensation, more than 55% of firms reported increases in the past three months, while 45% reported no change. Most firms (58%) have not adjusted their 2023 budgets for wages and compensation, but almost 33% plan to increase wages and compensation more than originally planned.