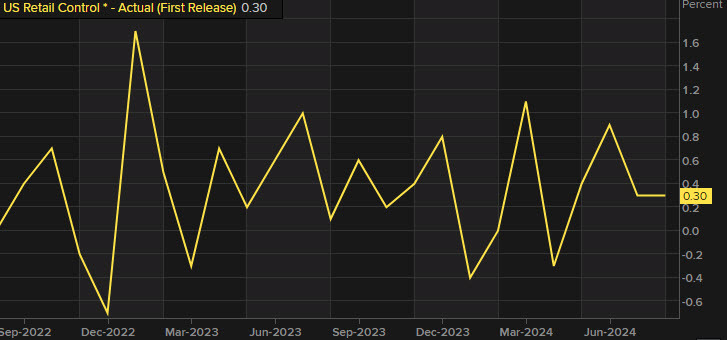

US retail sales control group

- Prior -0.2%

- Retail sales $710.8 billion versus $709.7 billion prior

- Retail sales +0.1% versus -0.2% expected

- Prior m/m sales +1.0% (revised to +1.1%)

- Retail sales YoY +2.1% versus +2.7% prior

- Ex autos +0.1% versus +0.2% expected

- Prior ex autos +0.4% prior

- Control group +0.3% versus +0.3% expected

- Ex autos and gas +0.2% versus +0.4% prior

- Full report

Heading into the report, market was putting a 63% probability on the chance of a 50 bps Fed cut, that's up to 67% afterwards but the numbers have been choppy. In contrast, US 2-year yields rose to 3.59% from 3.58% on the data.

There are no big surprises here but the numbers are a touch on the strong side at first blush. The US dollar is higher on a few fronts but only around a dozen pips.

Some details:

- Food services & drinking places 0.0% versus 0.2% prior

- Nonstore retailers +1.4% versus -0.4% prior

- Gasoline stations -1.2% versus 0.5% prior

- Building materials +0.1% vs +0.8% prior

- Clothing stores -0.7% vs +0.1% prior

- Motor vehicle & parts dealers -0.1% vs +4.4% prior