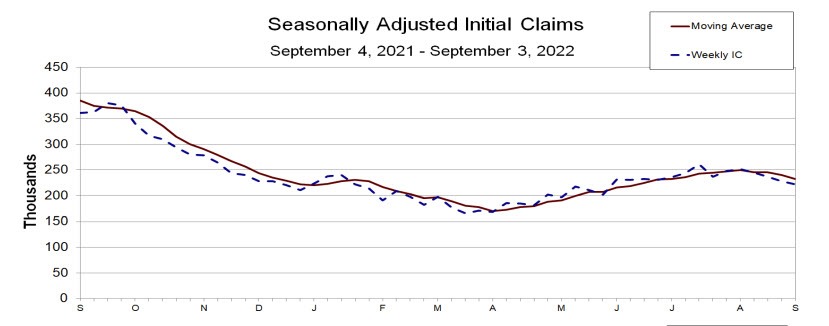

- Initial jobless claims 222K vs 240K estimate.Lowest since May 27 week. The prior week was revised to 228K from 232K

- 4 week moving average 233K vs 240.50K (revised)

- continuing claims 1.473M vs 1.435M. The prior week was revised to 1.437M vs. 1.438M

- 4 week moving average 1.439M vs 1.4283M last week

The lack of slack in the labor market is a concern for the Fed. Jason Furman* had an op ed in the Wall Street Journal where his study concluded:

"....if the unemployment rate follows the Federal Open Market Committee’s median economic projection from June that the unemployment will rise to only 4.1%, then the inflation rate will still be about 4% at the end of 2025. To get the inflation rate to the Fed’s target of 2% by then would require an average unemployment rate of about 6.5% in 2023 and 2024."

The current unemployment is at 3.7%.

*Mr. Furman, a professor of the practice of economic policy at Harvard University, was chairman of the White House Council of Economic Advisers, 2013-17.