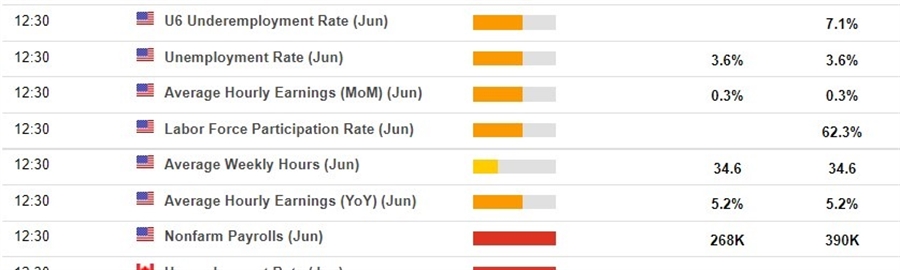

Due at 1230 GMT:

Snippet via Société Générale:

- Employment gains are slowing, and we view this as inevitable as more of the unemployed have found jobs and the unemployment rate has dropped well below 4%.

- Strong employment, however, is how we interpret an increase of nearly 300K jobs in a month.

- Trucking, delivery, food services and healthcare remain areas of recovery and growth for job markets.

- We expect the unemployment rate to edge back down to 3.5% for June, possibly very soon.

- A rising labor force participation rate (more people entering the labor force) is one pro-growth factor that can steady the unemployment rate, preventing a decline, even when the economy is strong. Later, as businesses reduce their demand for labor, smaller job gains are why the unemployment rate stabilizes or begins to rise.”

Westpac:

- payrolls should reflect moderating but still healthy jobs growth in June (Westpac f/c: +300k, market f/c +268k),

- keeping pressure on the unemployment rate (Westpac & market f/c: 3.6%)

- and supporting robust growth in average hourly earnings (Westpac & market f/c: 0.3%).