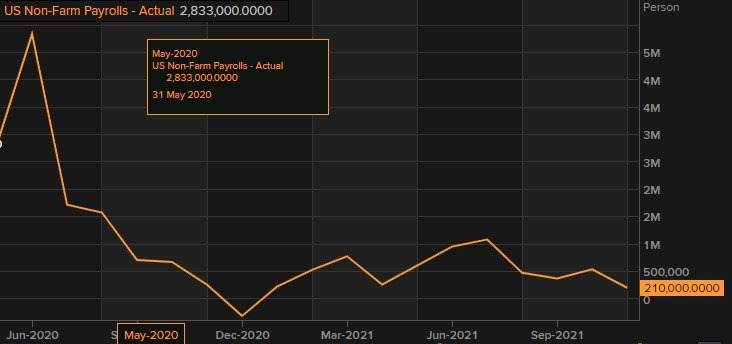

US nonfarm payroll employment data for November 2021

- Prior was 531K revised to 546K

- Two month net revision +82K

- Non Farm Payroll 210K vs 550K estimate

- Unemployment rate 4.2% vs 4.5% estimate. Last month unemployment rate 4.6%

- Participation rate 61.8% vs 61.6% estimate. Last month 61.6%. Prepandemic 63.5%

- Underemployment rate 7.8% vs 8.4% estimate. Last month 8.3%. Prepandemic 7.0%

- Average hourly earnings YoY 4.8% vs 5.0% estimate. Last month 4.9%

- Average hourly earnings MoM 0.3% vs 0.4% estimate.

- Change in manufacturing payrolls 31K vs 50K estimate. Last month +60K.

- Total private jobs 235K

Looking at the different sectors:

Goods Producing 60K versus 108K last month

- Manufacturing +31K vs 48K last month

- Construction +31K vs 43K last month

- Mining and logging -2K vs +3 K last month

Service jobs 175K versus 534K lat month (revised from 496K last month):

- Trade transportation and utilities 37K

- Information -2K

- Financial activity 13K

- Professional business services +90K

- education and health services plus 4K

- Leisure and hospitality +23K

- Other services +10 K

Government jobs -20 5K:

- Federal + 2K

- State -9K

- Local -18K

Some good and bad in the report. The nonfarm payroll number was obviously much lower than expectations. The two month revision saw October revised higher by 15K. September was revised higher by 67K for a net two month revision of +82K.

The unemployment rate declined faster than expectations and the participation rate moved higher as well.

The under employment rate was also lower than expected.

Average hourly earnings came in at touch weaker which is a positive for inflation but still remains high at 4.8% year on year.

The initial dollar reaction was to the downside but those gains have been reversed.

- The EURUSD moved above its 100 hour moving average at 1.13125, but is back below that level at 1.1310 currently.

- The GBPUSD moved up to test its 100 hour moving average at 1.33036, but is back down at 1.3286 currently.

- The USDJPY fell below its 100 hour moving average at 113.23 to a low of 112.977, but is back in trading right near the 100 hour moving average level

US stock futures are higher with the NASDAQ up around 92 points. The Dow industrial average is lagging but still up 100 points