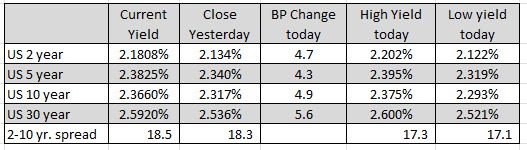

US stocks are open and the major indices are opening with gains. The moves come despite rises in yields once again. The 2 year yield is up 92 basis points this month. The 10 year is up 68 basis points. There was a time when the Nasdaq would have gotten wrecked. Not today and it performed well yesterday despite the move big moves in the market yesterday.

The snapshot of the market is showing:

- Dow industrial average is up 175 points or 0.51% at 34733

- S&P index is up 23.11 points or 0.52% at 4484.34

- NASDAQ index is up 72 points or 0.51% at 13908

- Russell 2000 is up 11.94 points or 0.58% at 2078

A look around the markets is showing:

- Spot gold is down $12.20 or -0.63% at $1923.50 as it reacts to higher yields

- Crude oil is trading at $109.61. That's down $-0.35.

- The price of bitcoin is higher today by nearly $2000 and $43,042. The price of bitcoin moved above its 100 day moving average and looks set to close above that level for the first time since December 2. That moving average comes in at $42,246

In the US debt market, the yields are up four – five basis points across the board. The 2– 10 year spread is trading around 18.5 basis points.

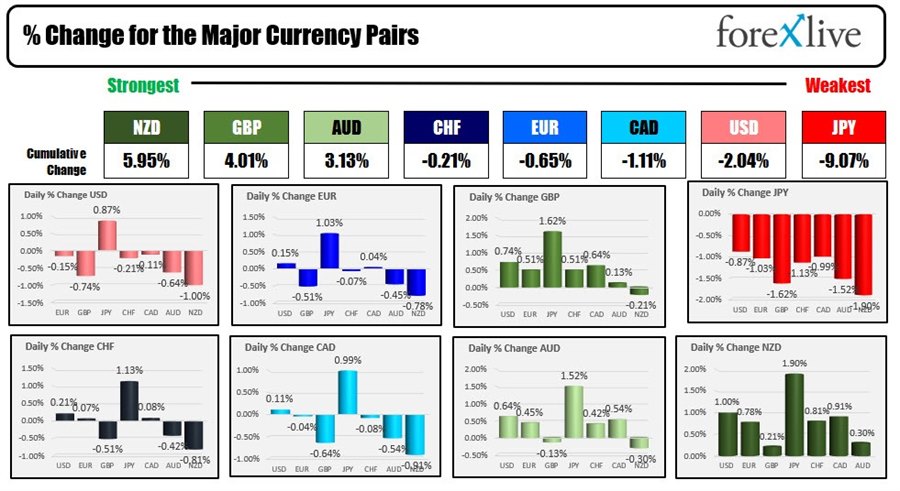

A snapshot of the forex market has the NZD as the strongest of the major currencies. The JPY is the weakest as the USDJPY soars above the 120.00 for the first time in 6 years. The USD is weaker as it follows the risk-on flows now.