The USD has moved lower after Fed Powell says the Fed will look to raise by 50 bps at the next 2 meetings. The markets were pricing in up to 4X 50 bps.

US stocks are higher.

US stocks move higher

In the forex:

- EURUSD has moved sharply higher and trades above its 200 hour moving average at 1.05935. Stay above the 200 hour moving average will have traders targeting the 38.2% retracement 1.06480. Stay above the 200 hour moving average is now close risk

- GBPUSD ; The GBPUSD rates back above its 100 hour moving average 1.25174 and looks toward the 200 hour moving average at 1.25887 as the next upside target. A move above that level will have traders targeting the high from last Friday at 1.26145 followed by the 38.2% retracement of the move down from the April 21 high at 1.26698

- USDJPY: USDJPY has moved sharply lower and it tests its 200 hour moving average at 129.243. The price is dipping below that level and test the 50% of the move up from the April 27 low and the swing high from April 22 at 129.088. Close risk comes in at the old swing high from April 20 at 129.394. A move below 1.29088 would have traders targeting a swing area between 1.2863 and 1.2870.

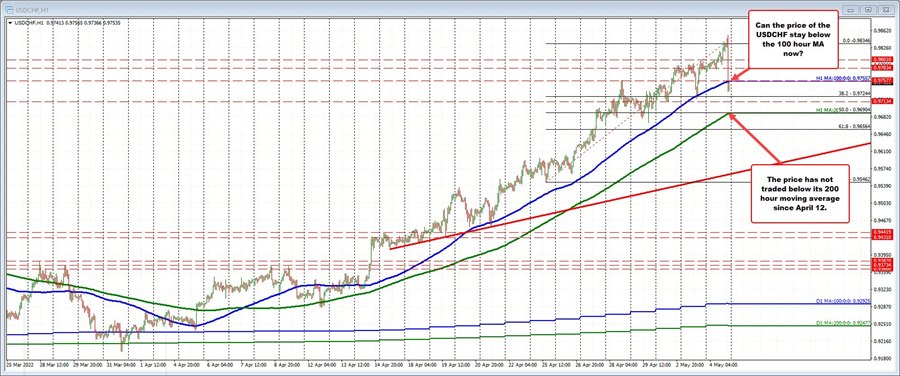

- USDCHF: The USDCHF is lower on the day for the 1st time after 9 days higher. The price is below the 100 hour MA at 0.97554. The price moved briefly below the 100 hour MA yesterday and bounced back quickly. That was the same reaction back on April 21. Traders will be watching that MA level going forward. Stay below and more downside momentum toward the 200 hour MA at 0.96904 would be eyed.

USDCHF falls below its 100 hour moving average