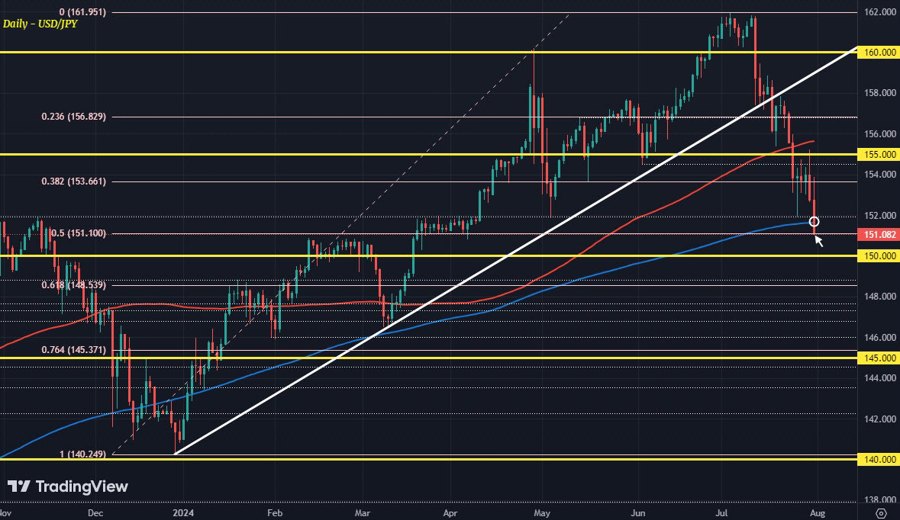

It's make or break time for USD/JPY as sellers continue to stay in charge. The pair is now treading water below its 200-day moving average (blue line) of 151.63 and that could set up for a steeper fall to come next. The 50.0 Fib retracement level of the swing higher this year is seen at 151.10 and is also under threat currently.

BOJ governor Ueda didn't say too much in his press conference earlier but said enough. He mentioned that he doesn't view 0.50% policy rate to be a ceiling and that a weaker yen definitely played a role in their decision today, even if it wasn't a big factor.

I would say there would've been a major backlash against Japanese officials if they didn't hike today. So, in hindsight, leaking the 15 bps rate hike yesterday was perhaps a bold but effective move on their part.

Going into the decision earlier today, there was still an argument for it being a case of buy the rumour, sell the fact in the yen currency. That especially after letting the dust settle. But after Ueda's presser and the price action currently, yen bulls are primed to take control in the driver's seat.

The 150.00 mark will be a big psychological level to be mindful of next on any further downside extension. But we'll see how the daily close pans out first and foremost. It's not set in stone yet with the Fed coming up later today.