US stocks back higher after dipping into the red

The European major stock indices are ending the day with modest gains.

The provisional closes are showing:

- German DAX, +0.1%

- France's CAC, +0.46%

- UK's FTSE, +0.08%

- Spain's Ibex, +0.4%

- Italy's FTSE MIB bucked the trend and is closing down -0.4%

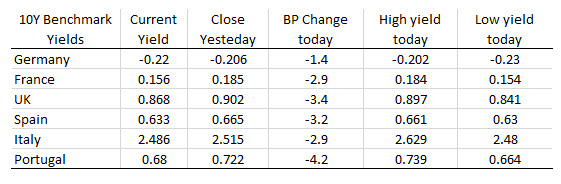

The benchmark 10 year yields in Europe are lower. Italy, which was higher earlier, reversed the flows and also fell on the day. German yields remain around the -0.20%.

in the US stock market, the markets have been whipping around. Both the S&P and NASDAQ gave up solid early gains, and moved into the red (negative), but are now both higher again. The snapshot as London/European traders look to exit show

- the S&P index of 12.72 points or 0.45% at 2816.0

- The NASDAQ index of 25 points or 0.34% at 7552

- The Dow is up 148 points or 0.59% at 25480

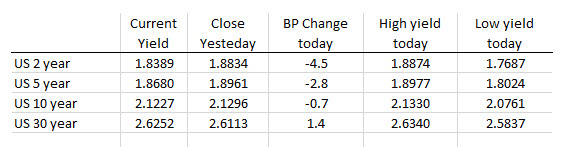

In the US debt market, the 2 year was down nearly 10 basis points earlier in the day but are currently only down about 4 bps. The 30 year is higher as the yield curve steepens a bit.

A snapshot of the Forex market is showing that the NZD remains the strongest of the majors and the AUD is the weakest (so AUDNZD is falling). The RBNZ said that they may keep rates steady earlier in the day which helped support the NZD pairs.