Price moved up from 1.1888 to a high of 1.1920 in the NY session

In an earlier post, the EURUSD had showed some corrective upside potential on the 5 minute chart as the trend move lower, lost steam. The price was trading around 1.1888 at the time.

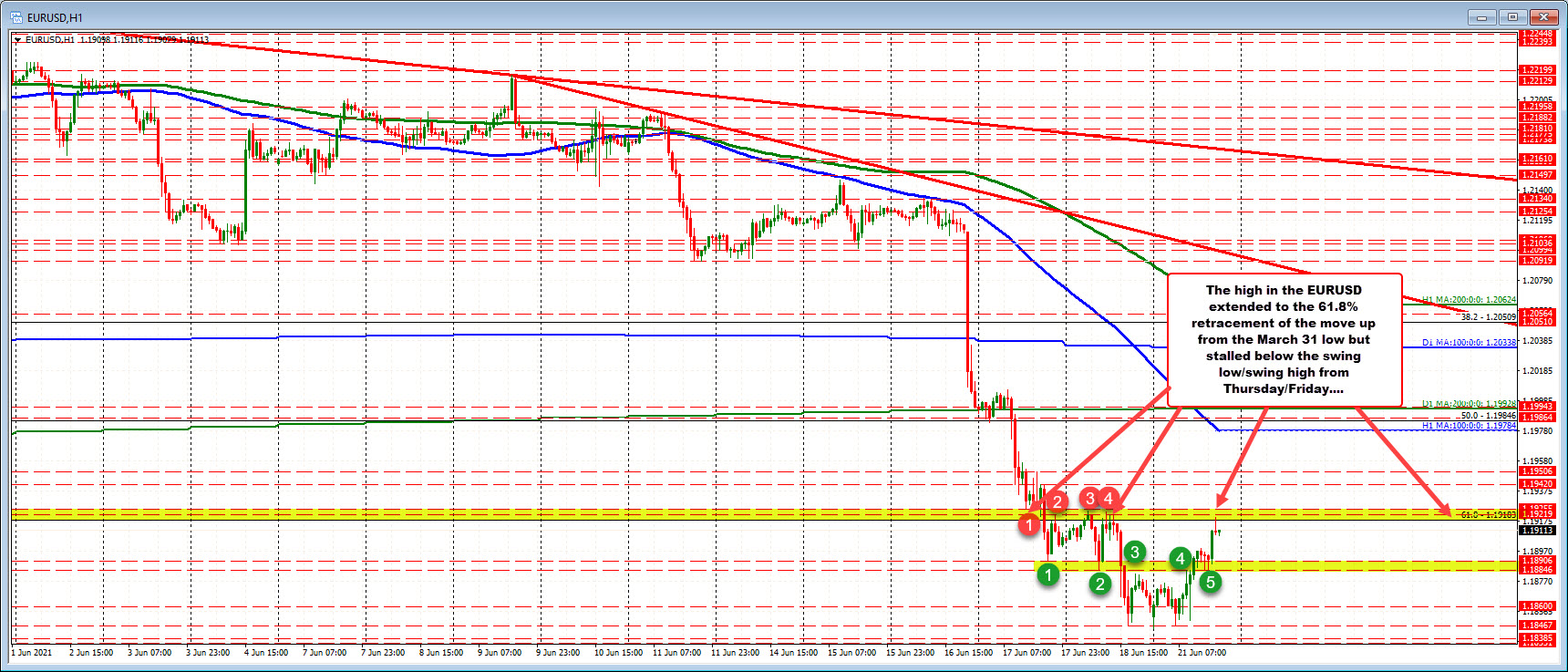

The price extended higher and moved toward the next targets including the 61.8% retracement of the move up from the March 31 low to the May 25 high at 1.19183. Along with swing lows/swing highs from Thursday and Friday that topped out at 1.1925. The high price just reached 1.19201 - between those two targets - and the price has rotated modestly to the downside. The low move to 1.1908.

Going forward, getting back above the 1.1925 level is still a upside target (it is also near the midpoint of the move down from Thursday's high - see 5-minute chart below). Move above that level and traders would start to target 1.19453 (61.8% of the same move).

Buyers are still on an "upside corrective probe" after the sharp fall last week. The price remains above the rising 100 bar moving average on the 5-minute chart at 1.18932 which is also a short term positive.

PS. The EURUSD range is up to 75 pips with the 22-day average at 68 pips based