Dollar weakens

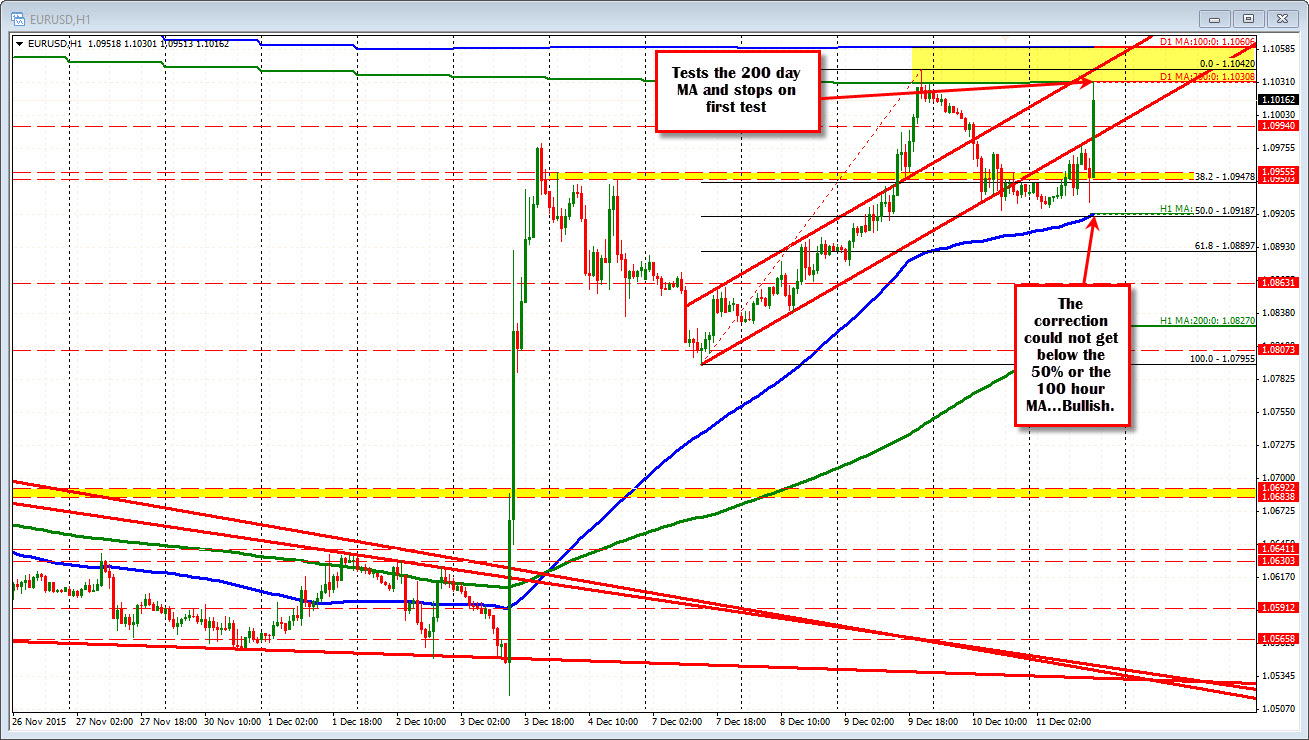

The EURUSD is moving sharply higher and is back up testing the 200 day MA at the 1.10308 level as stocks (down -1.40%) take a dive on the opening and bond yields fall (down 7 BP) Oil is down trading below $36 (-2.39%). First time since 2009.

The EURUSD tried to move lower yesterday and even on the initial reaction to the data today, but dollar bulls are not out there for long - or so it seems - and the buyers entered.

Technically, the price is back into the old channel after breaking below yesterday (at 1.0982 currently). The 200 day looms above at the 1.0307 level and is providing a ceiling on the first test. On Wednesday, the price moved above this moving average but fell short of the 100 day MA at 1.10603 (high reached 1.1042 - see yellow area in the chart above).

The thing about the EURUSD it trades like shorts are still caught. The corrections (the one yesterday) are stalling above the 50% areas. The moves higher have more urgency. Of course the market gets help from the stocks and oil. They go down and the dollar follows now.