ADP? Not much there. Maybe employment on Friday. Maybe it will be the Fed.

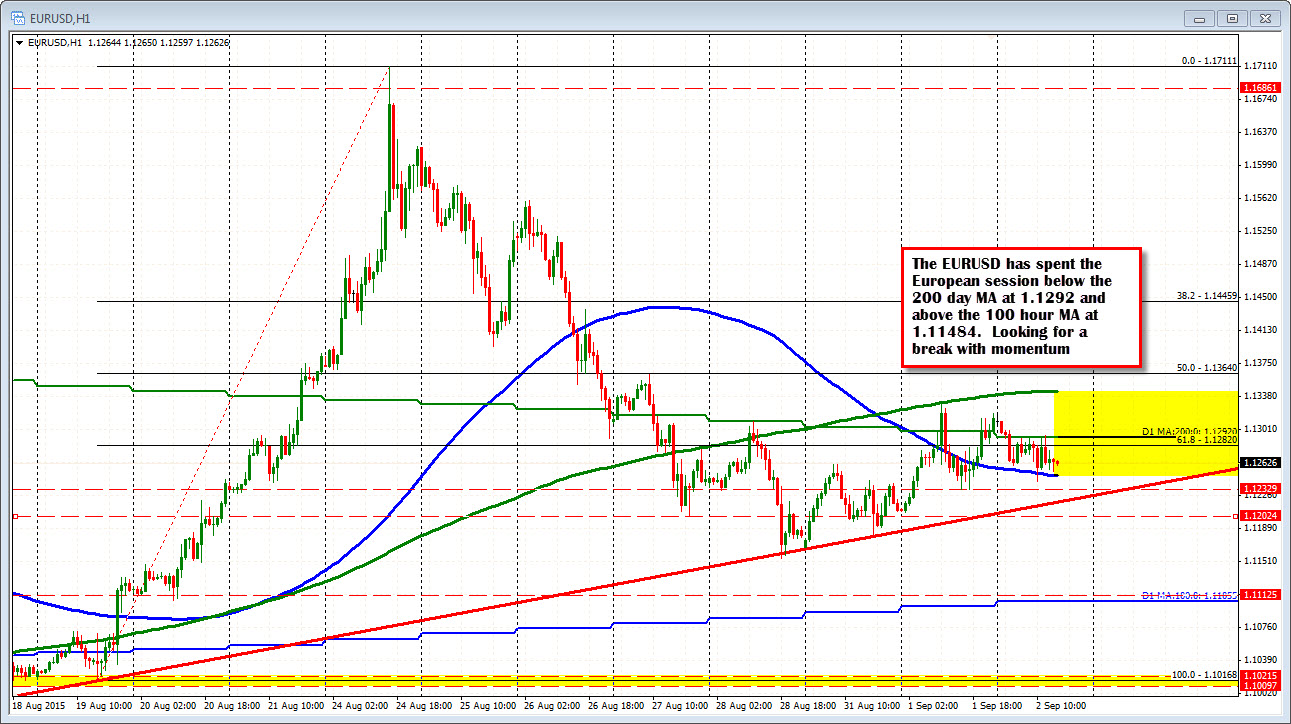

The EURUSD waits. It has spent most of the day trading under the 200 day MA at 1.1292 and above the 100 hour MA at 1.1249. The low for the day did extend to 1.12416.

Let's face it...the market is confused. It is a holiday week in the UK (on Monday) and one coming up in the US. China stocks are closed for the rest of the week. The Fed may have missed lift-off opportunity. The stock market is looking as if it wants to continue to tumble (Bill Gross says to go toward square). When the US stock market plunged on August 24, the EURUSD rallied sharply higher. Why? I am not sure many could explain it (it just got a head of steam going), but yesterday, the stock had a pretty good move lower and the EURUSD pair moved up, down, and up but it was not with the gusto of a few weeks ago. If anything, EURGBP rising was a catalyst for the end of day rally. So all says that the "market" does not know and hangin' around the 100 hour MA (at 1.1248) the 200 day MA (at 1.1292), the 200 hour MA was tested yesterday and held (at 1.1343 currently - green line in the chart above).

For trading, keep it simple. look to play a break. ADP did nothing to ignite a fire. There should be a break at some point - either above the 200 day MA or below the 100 hour MA. The hope is that on a break there is a move from there (trend line on the downside being the next target and the highs from yesterday and the 200 hour MA the targets on the topside). In between, there is not a lot. I guess traders could take a clue from the 100 bar MA on the 5-minute chart that has capped the pair over the last few hours.