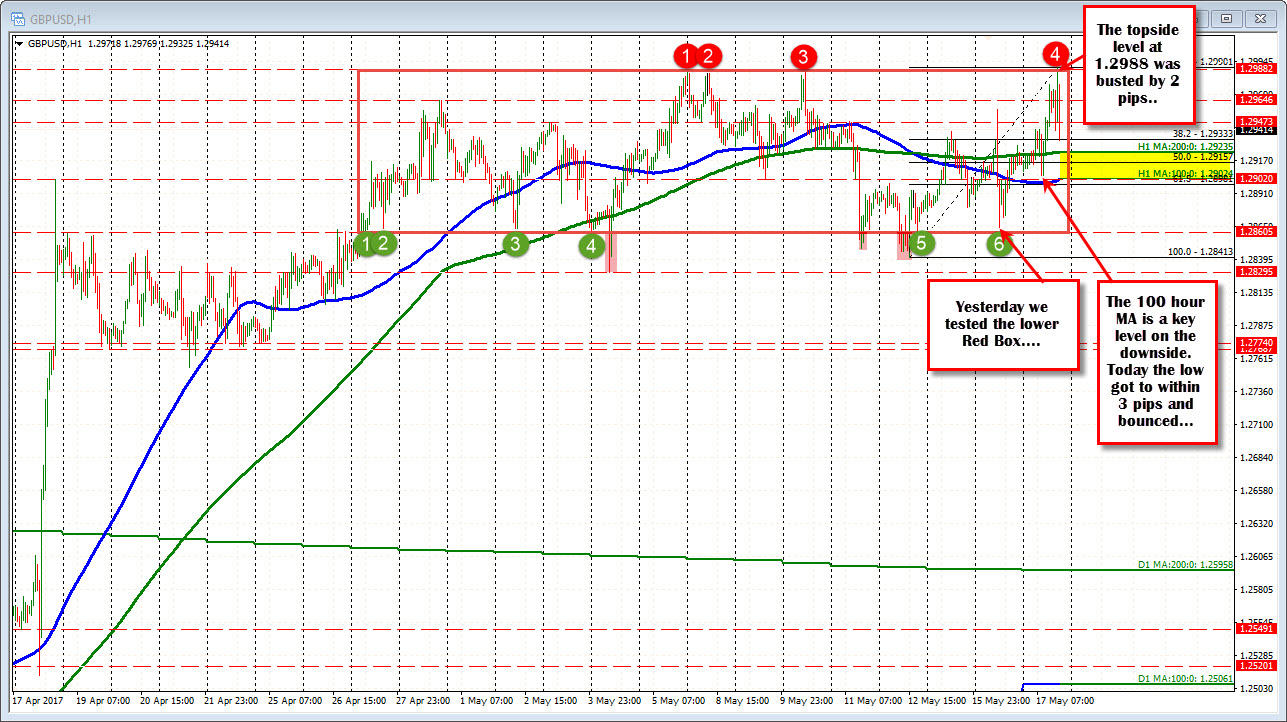

New high by less than 2 pips

The GBPUSD took a run to the upside on the USD selling, took out the triple high level by less than 2 pips and sold off. Make the triple top, a quadruple top now. Yesterday we got within 4 pips of the lower support level that has defined the Red Box in my GBPUSD post of late. That area encompasses from 1.2860 to 1.2988 (now 1.2990). It is now 15 days where most of the trading activity has been in that box (there have been 3 brief failed breaks outside of that box - red shaded areas). Of course 1.3000 is a tough round number that traders are also focused.

Now what?

The correction off the high, has taken the price to the 38.2% of the move up from last week's low. That level comes in at 1.2933. Traders are leaning against the level for an intraday trade. Hold and a march back higher may be in the cards (and perhaps another run at 1.3000 eventually).

Move back below the level, and the 100 and 200 hour MAs sit a little lower at 1.2902-1.2923 area (100 hour MA at 1.2902 and the 200 hour MA at 1.2923). Note that the 1.2902 level also has a number of swing levels where traders leaned for risk defining purposes (natural technical level at 1.2900). The low today stalled ahead of the 100 hour MA (at 1.2905). That MA is key.

The USDJPY and JPY crosses have been more of a trending trade today, but for this pair, traders were waiting for that opportunity to buy against the 1.2902 area, and also against the triple top and the 1.3000 level. Patience. Wait for your levels. It may not trend but you might catch some swings.