MAs and retracemene stall the fall

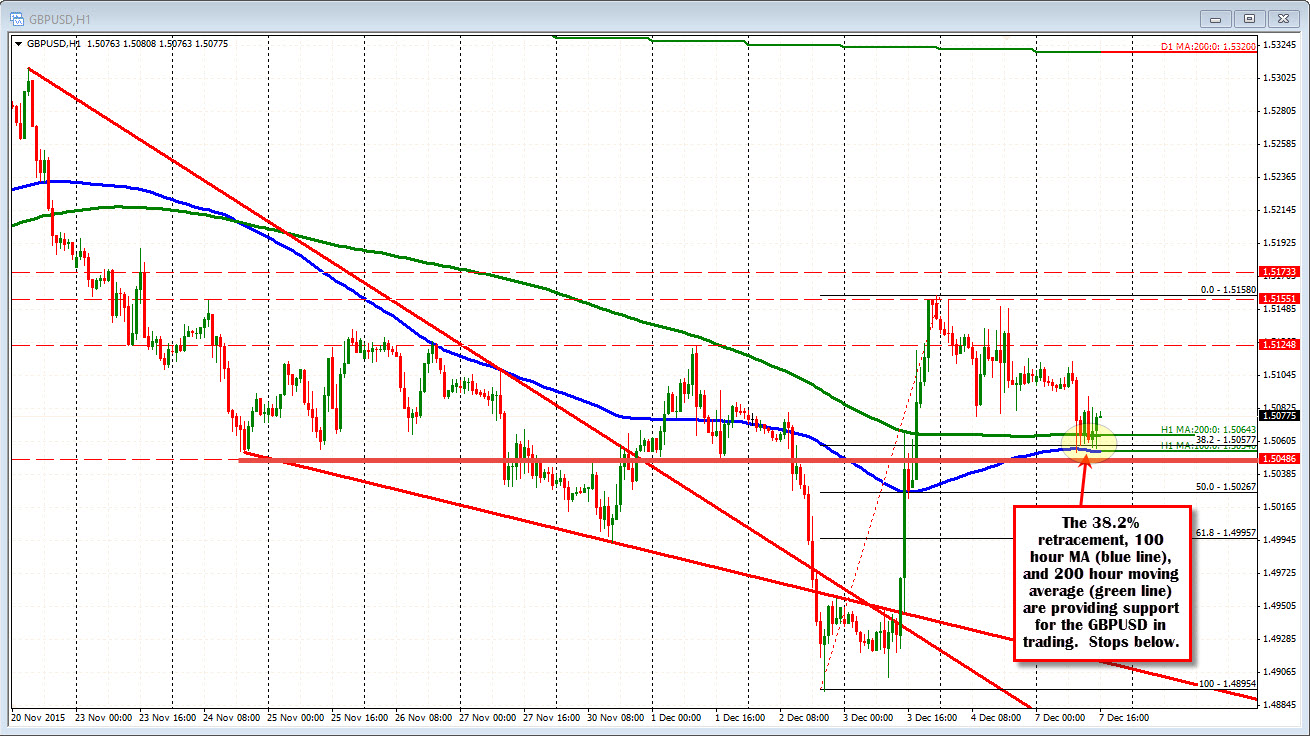

The GBPUSD has traded with a floor under it's feet over the last 5 hours. The 100 hour MA (blue line at 1.5054) and 38.2% retracement (at 1.50577) of the move up from the December 2 low, are providing the support. I guess the 200 hour MA (green line at 1.5064) is in the "support mix" as well.

Like the EURUSD, the GBPUSD rose last Thursday after the ECB surprised the market by being light on the stimulus, and subsequent Draghi press conference. The rise in the GBPUSD was at a slower pace as evident from the rally in the EURGBP (see chart below).

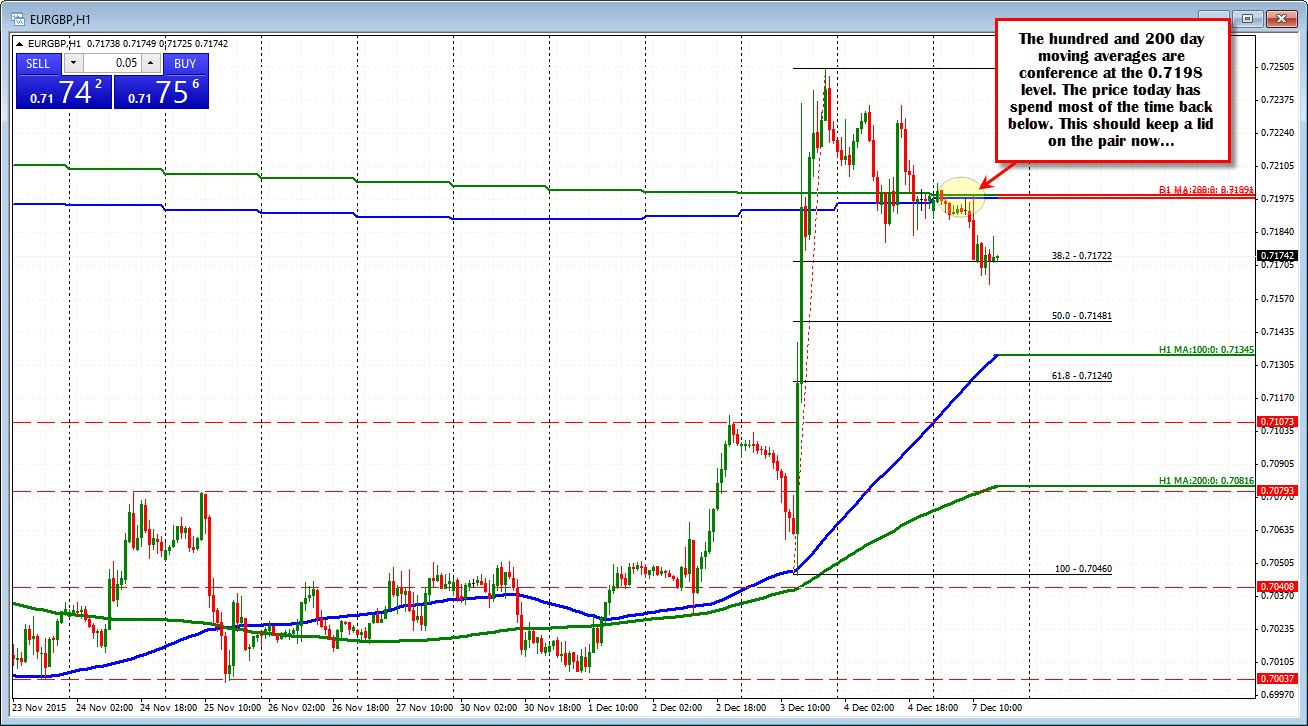

That bias in the EURGBP, may be losing some steam, however, as the pair is now trading back below the 100 and 200 day moving averages (see the overlay of the two moving averages on the hourly chart below). The price today has spent most of the time below those two moving averages (at 0.7198) and the level now becomes an important line in the sand for shorts to lean against. Look for sellers on rallies.

The softer EURGBP technical picture, may help to keep the GBPUSD supported with the 100 and 200 hour MAs providing the backdrop for traders to lean against (stops on a move below).

As for the EURGBP, look for sellers against the key 100 and 200 day MAs. IT is not often that the two daily MA and price converge (I call it Threes a Crowd) and typically, the price moves away from those MAs.

PS. Carney is speaking but did not comment on monetary policy. The BOE meets on Thursday. No change in policy is expected but the focus will be on the statement of course.