"Too good to be true" or "There is life after China"

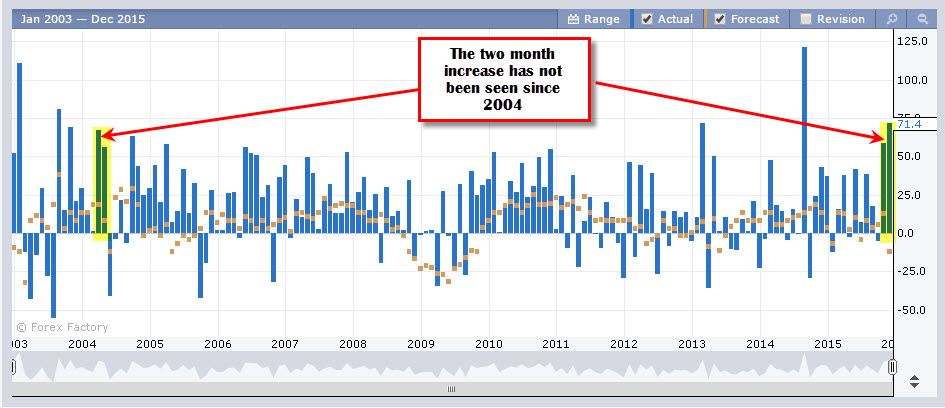

For the second consecutive month, the Australian job report shocked the market with a 71.4K increase. They were expecting -10K. That report comes after a 56.1K increase the prior month. The back to gains of this magnitude has not been seen since 2004.

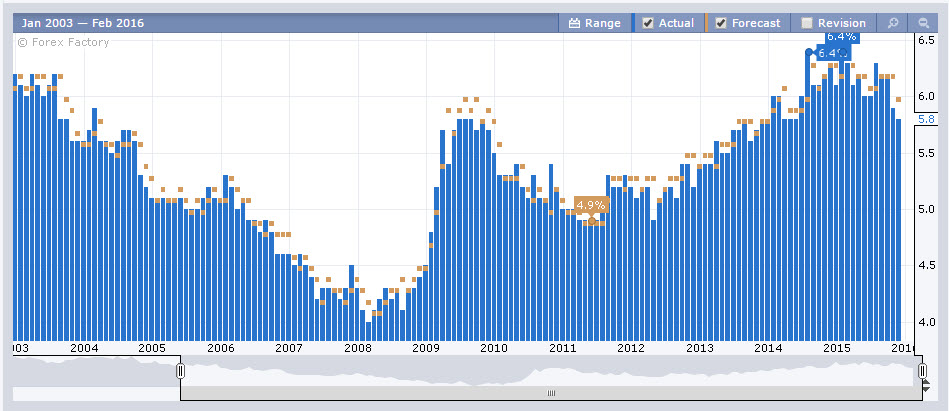

The unemployment rate also fell in the current month to 5.8% from 6.0%. That rate remains above the post-debt crisis low of 4.9% but below the trend from the commodity crisis high of 6.4%.

So job prospects are picking up as the economy transitions. Are the gains too good to be true given the slowdown in China or is there life after China and the Australian economy is transitioning.

The verdict may be still out. There is still work to be done on the employment rate. It remains above the post debt crisis lows but is below the post commodity price high. Regarding job gains, although traders may raise an eyebrow to the impressive gains, the trend is showing improvement on the employment rate and the job gains. So let's give the benefit of the doubt that there is a transition going on.

What does the RBA think? In the last statement (Dec 1), the central bank commented:

In Australia, the available information suggests that moderate expansion in the economy continues in the face of a large decline in capital spending in the mining sector. While GDP growth has been somewhat below longer-term averages for some time, business surveys suggest a gradual improvement in conditions in non-mining sectors over the past year. This has been accompanied by stronger growth in employment and a steady rate of unemployment.

They added that:

- Monetary policy needs to be accomodative

- That "economic conditions had firmed a little over recent months"

- But outlook for inflation may afford scope for further easing should that be appropriate to lend support to demand.

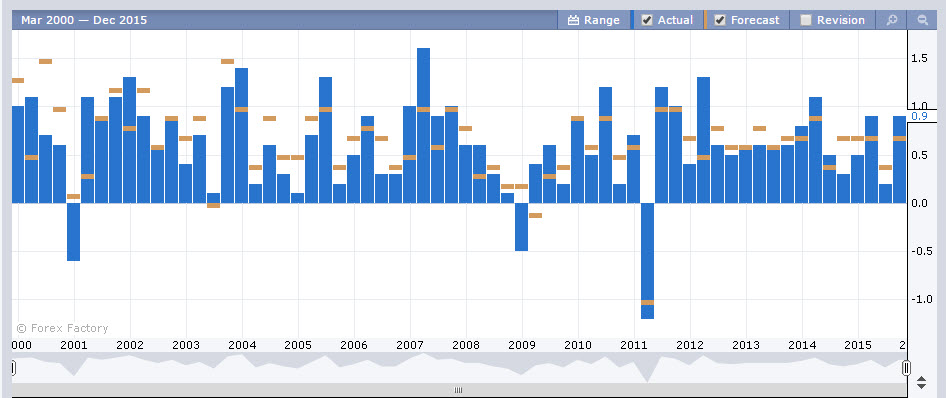

Since the statement, the trade balance was weaker at -3.31B vs -2.61B. China will stay be a headwind. However, domestic retail sales showed a 0.5% increase after back to back +0.4% increases in the previous 2 months. Not bad. GDP QoQ came in at 0.9% for the 3Q (QoQ) which was better than expectations. Given the headwind from trade, the bounce back from the 0.2% increase 2Q is good news.

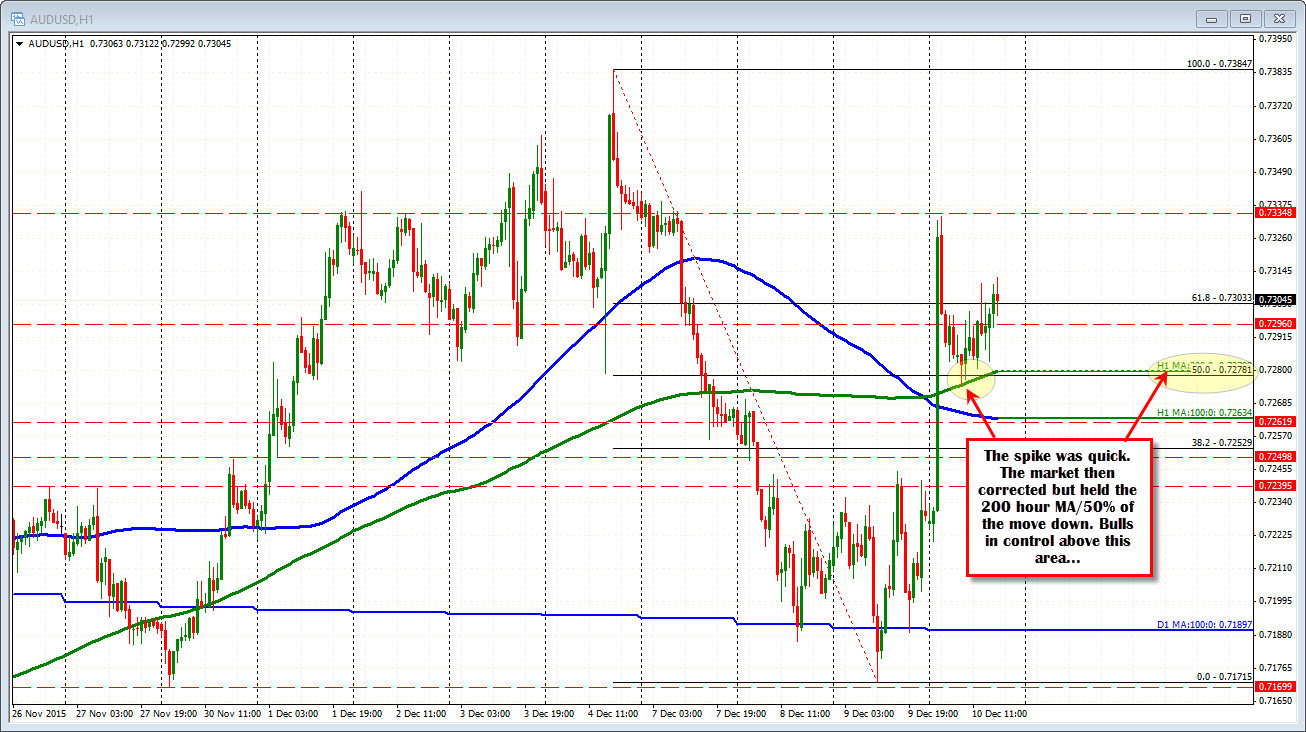

The employment report should not hurt the AUD and indeed the price is higher, but it is off the highs. However, the correction held the 200 hour MA like a charm (nice). The 50% of the move down from last Friday's high also attracted buying. So the bias is bullish. Moreover, the pair is moving away from the 100 day MA. Yesterday, the price fell below that MA but failed and climbed higher into the employment report.

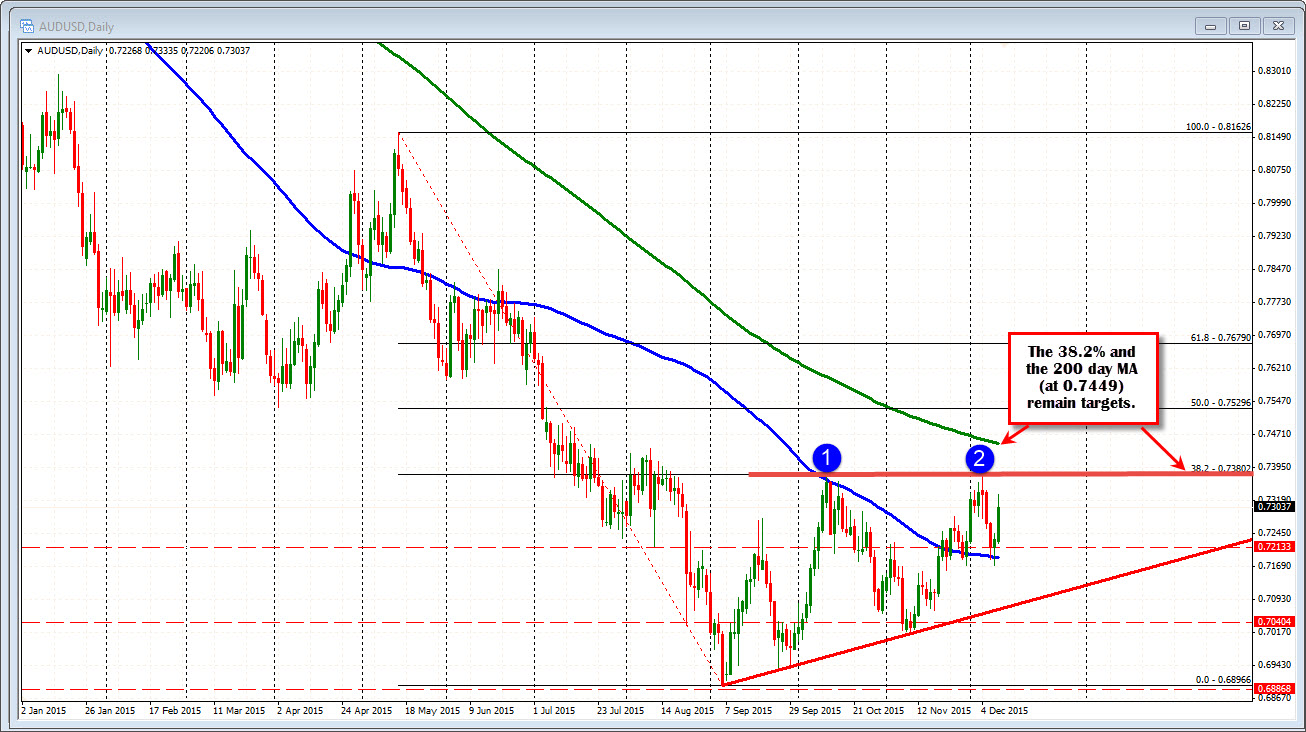

Looking at the daily chart, the 38.2% the 38.2% at 0.7380 area, has been a ceiling area for the pair. The 200 day MA is at 0.7452 is another target. The price has not traded above the 200 day MA since Sept 9, 2014.

There may be life after China after all, so look for buyers against the 200 hour MA (close risk). Ultimately, the technicals have to support that move. So far, the dip buyers at key support are keeping that idea alive. Can they push to the next limits? The market will decide. I can only define risk.