Profit taking area.

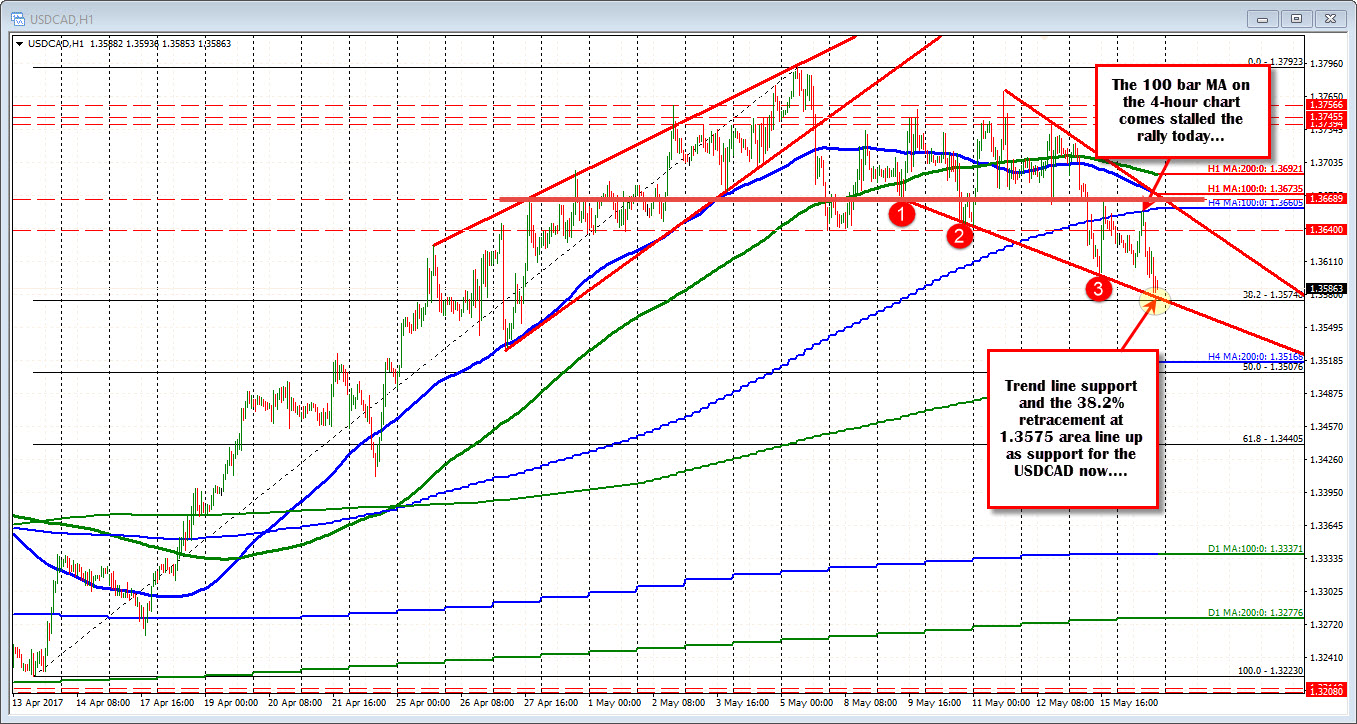

The USDCAD is trading near the low levels for the day. Earlier that the highs, the price tested the 100 bar moving average on the 4-hour chart at the 1.3660 area, and held that level like a charm.

The fall to the lows currently, has the pair looking to test a dual support level defined by the 38.2% retracement of the move up from the April 13 low, and the trend line that connects lows on the hourly chart going back to May 9. That will support comes in at the 1.3575 area. I would expect that traders would look to buy against the risk defining level, with stops on a break.

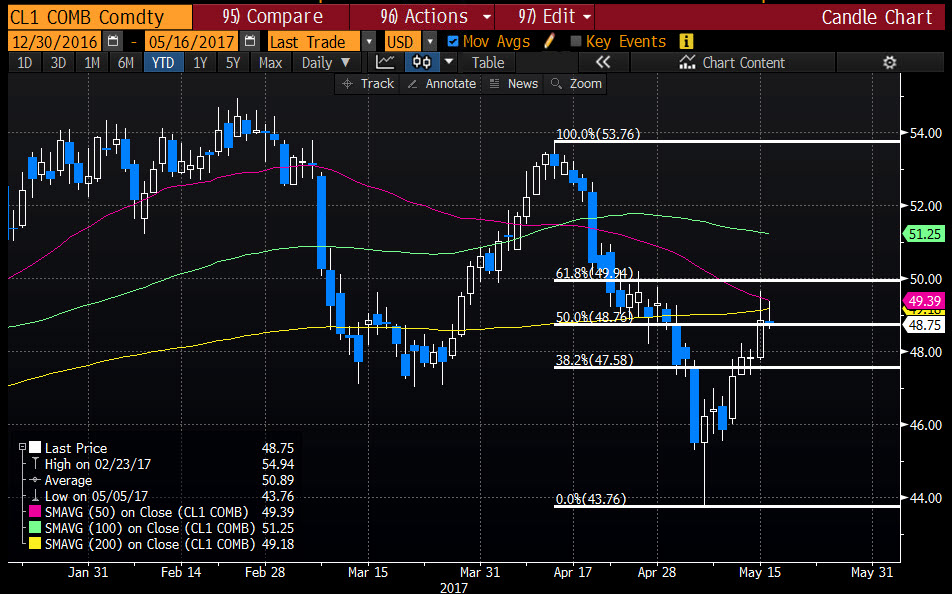

The USDCAD is lower despite a fall in the price of Crude oil. The current crude oil price is trading at $48.74. That is down about -$0.10 on the day, but is well off the highs at $49.38. A lower price of crude oil should help to weaken the CAD (higher USDCAD). Instead, the USDCAD is lower from the 1.3631 close from yesterday. That should help provide a floor at support for the pair.

Technically, the price of the crude oil is below the 200 day MA at $49.18 and near the 50% of the move down from the April high at $48.76. A close below both those levels would be more bearish for the contract.