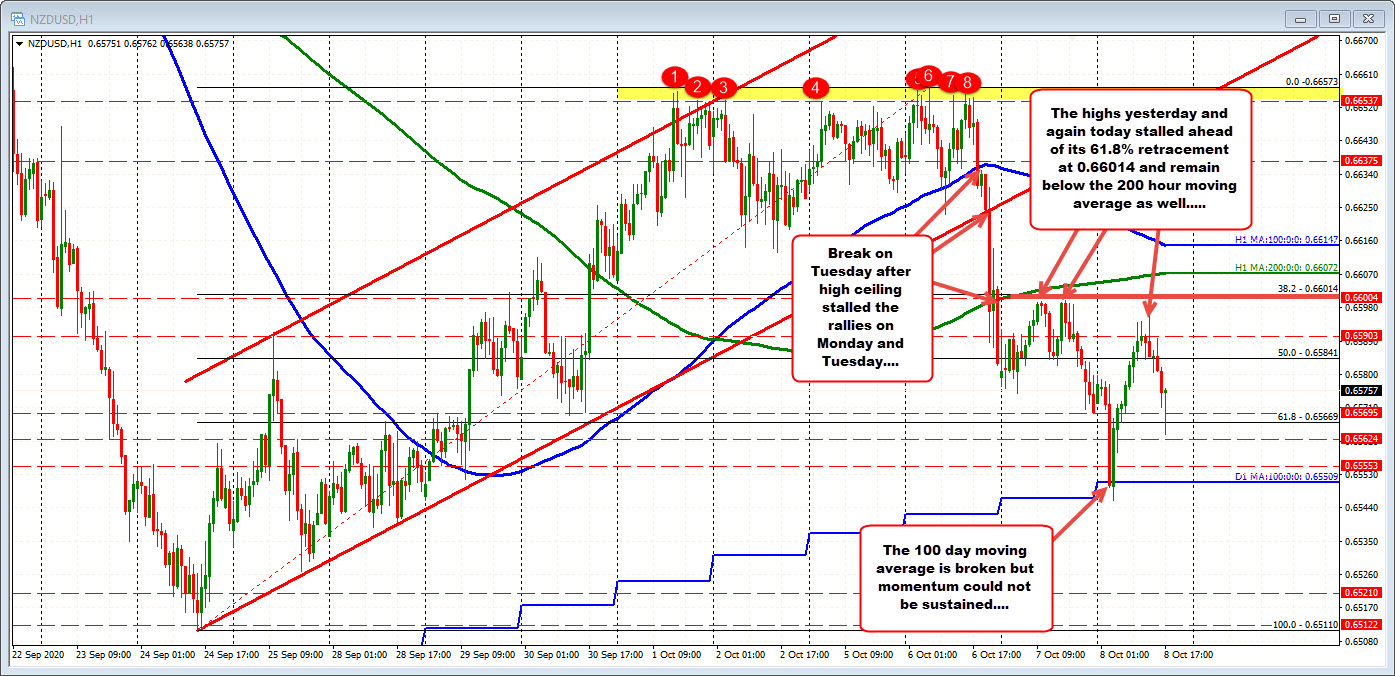

The low stalled near its 100 day moving average.

The NZDUSD moved lower in Asian trading on a Reuters headline saying 'actively working' on negative interest rate and funding-for-lending programme. That sent the pair tumbling lower, but traders came in near its 100 day moving average at 0.6550. The low for the day reached 0.6546 before snapping back to the upside.

The run higher, however, found sellers ahead of its broken 38.2% retracement at 0.66014. The high prices from yesterday stalled at 0.6599. The high price today reached 0.6589.

The last 4 hours have seen a move back to the downside as the up and down trading continues. The pair is currently trading right around unchanged levels on the day.

What now?

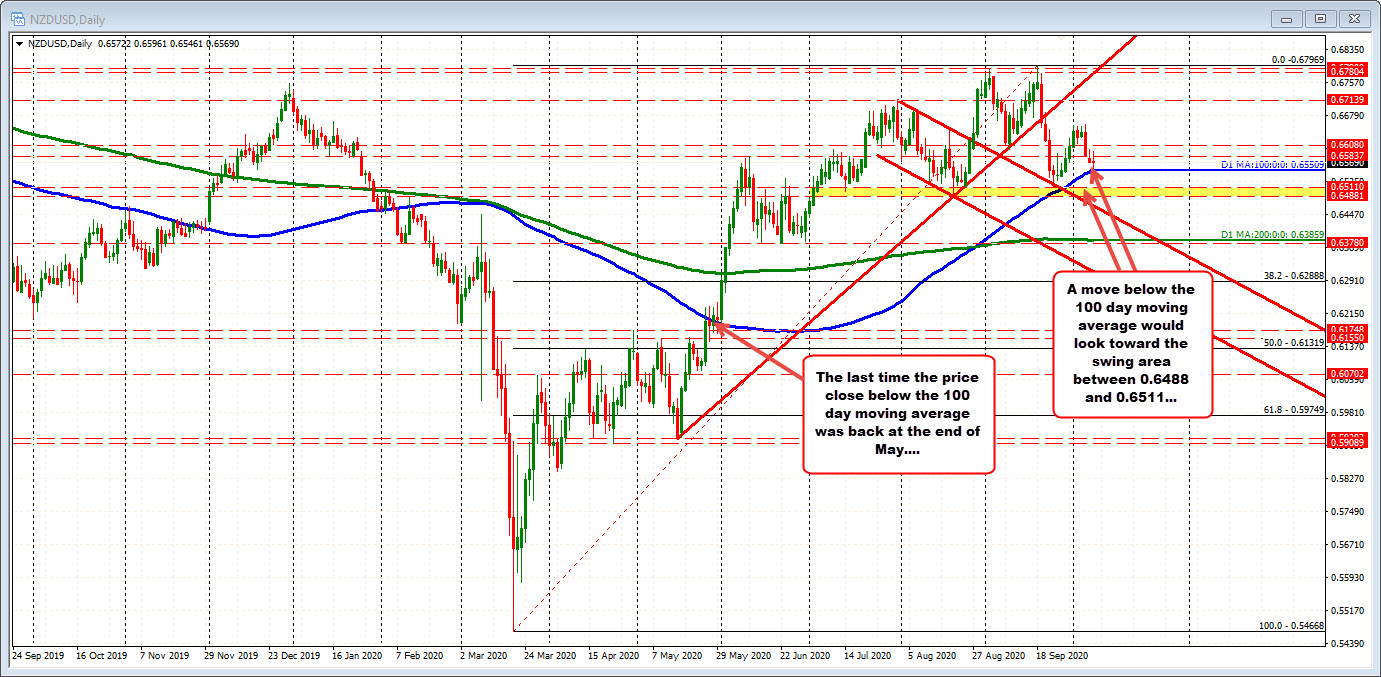

The 100 day moving averages key on the downside. The price has not closed below that moving average since the end of May (when the moving averages much lower - see daily chart below). It will take a move below to solicit more selling.

A break of that moving average and the next target would have traders looking toward the 0.64882 and 0.6511 swing area.

On the topside, getting back above the 50% retracement at 0.65841 should tilt the bias a little more to the upside. However the 0.6600 area and the 200 hour moving average at 0.6607 and 100 hour moving average at 0.66147 would be topside targets to get to and through.

Of note is that despite the sharp run-up in US stocks yesterday, the NZDUSD failed to participate in a "risk on" way. That is eyebrow raising and indicates some reluctance to the upside for the pair.

On Monday and Tuesday of this week, the pair could not sustain momentum above the highs from last week. Also on Tuesday, the price tumbled below the 100 hour moving average and 200 hour moving averages. The price has stay below that 200 hour moving average since breaking.