I don't think the loonie has ever seen so much attention, yet here it is on centre stage

Understandably there lots of talk going on about how and where to trade these crazy moves. The best piece of advice I could probably give right now is don't fret about missing out. It's easy to look at the huge pip moves and feel left out. Entering a trade with that on your mind is usually the quickest way to lose money. Remember the saying "Fools rush in where angels fear to tread". I've been that fool many times in the past. It doesn't work

So what if you've missed it? It's not the last ever time we'll see a currency pair do that. My strategy is always to take a step back, away from the near term noise, and look at the wider picture to see if there's any real opportunities that come with reduced risk

What I do is start as far out as possible to get a feel for the bigger picture then drill it down

A look at the yearly chart makes easy reading

USDCAD yearly chart

There's been action at every 1000 pip big figure. Take the closest at 1.40. It's had 7 resistance points where the price failed to hold above and one support point. It's been a very strong level

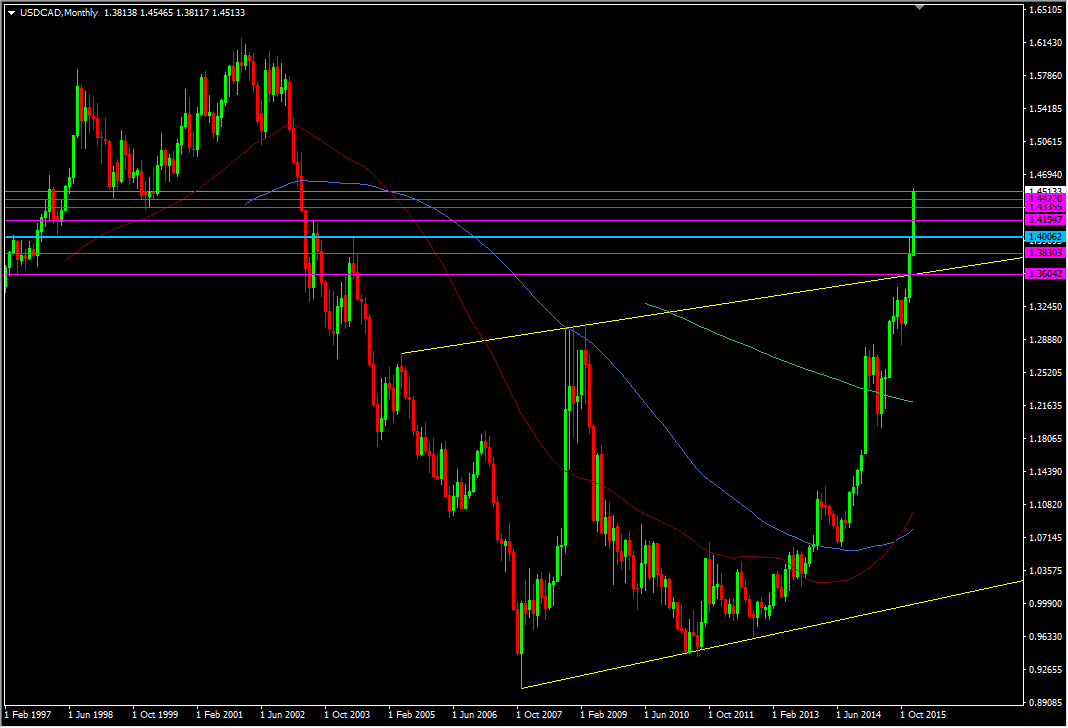

Drill it down to the monthly chart and the level becomes better defined

USDCAD monthly chart

Now we can see where the levels really start being defined as we come down the timeframes, and now we can find levels where those yearly candles have blown through or held below. We see that 1.4200 has held resistance in the 1997 pop and then after the 2003 break. Slowly we're building up a picture

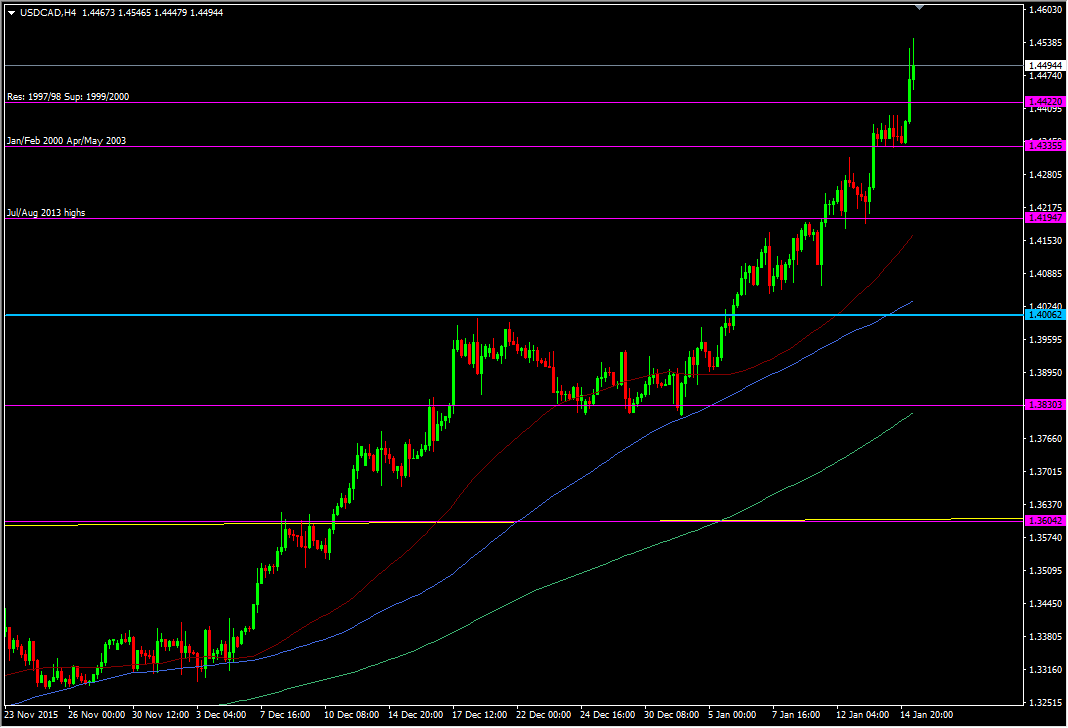

Now the important part. We can shift down to the H4 chart and see how things are trading in the here and now. I've titled the horizontal lines from the Monthly.

USDCAD H4 chart

1.4000 speaks for itself. We got close a few times then broke and not really looked back. 1.4050/60 is where support came in and being so far above 1.4000 that's a strong signal of how powerful this move is. We didn't even get a test down to somewhere close to 1.4020 or so.

Next came 1.4200. Again we saw resistance before the break. It found support but not as strong

We carved through1.4335 (Check the monthly and you'll see the whole the area on that of 1.4300-1.4340 is valid) and then found very good support

On we went through 1.4400, and the 1.4420 area marked all the way back in time, but here we find ourselves in a bit of limbo.

Where do we go next and how do we trade it?

You always have to be careful with big volatile moves. What can go up quickly can retrace just as quickly. Sometimes you need to let the levels develop so move down the timeframes again.

USDCAD 5m chart

Right now 1.4500 is trying to build as support but looks like it's struggling. Not a great level to lean on. 1.4465/75 looks a bit stronger and 1.4450 looks a bit weaker. Take it in context, this is a 5 minute chart so treat the strength accordingly

After all this, what are the levels that I'd be watching with a thought to trade?

The H4 chart looks to be the best to play from the long side;

- I'd look at 1.4400/20 for a long against that support

- 1.4335 is next, down to 1.4300. It looks solid

- 1.4200 - 1.4175 There's been enough action there to say it will play a big role

- 1.4045/55 is that level that found support ahead of 1.4000

For a short trade, (I've only picked a couple of standout levels) I've not seen anything I'd like to look at until 1.4850ish, 1.4950 then 1.5000

The exercise here is to try and remove any indecision and to see the trades with clarity, while not getting caught up in the moment, and then end up doing something stupid. You have to put the work in to do that though. From doing this I've now got 3 upside levels and 5-6 downside levels that are worth looking at. I may not trade all the levels, or any of the levels, and there's still work to be done to form a plan if I do (stops, targets etc) but now I'm not guessing and I'm not shooting in the dark. I've taken out the emotion and volatile noise and have something concrete to focus on.

If you can do that then you put yourself in control rather than handing over that control to the market